Professional illustration about MicroStrategy

Bitcoin in 2025: Trends

Bitcoin in 2025: Trends

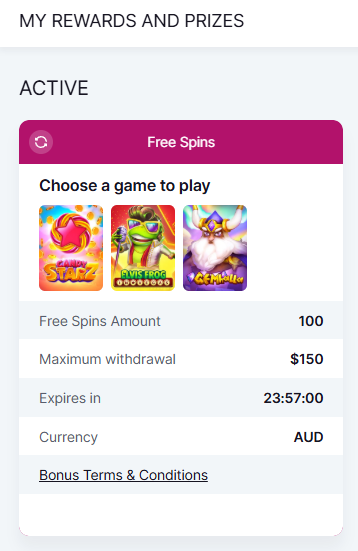

As we move deeper into 2025, Bitcoin continues to dominate the cryptocurrency landscape, with its market cycles and price dynamics reflecting both maturity and volatility. Institutional adoption has reached new heights, with companies like MicroStrategy doubling down on their BTC holdings, while asset managers such as BlackRock have further integrated Bitcoin into mainstream financial products. Exchanges like Binance and Coinbase are reporting record trading volumes, signaling sustained retail and institutional interest. Meanwhile, El Salvador remains a pioneer in national adoption, with its Bitcoin-backed bonds and Lightning Network infrastructure setting a benchmark for other nations.

Technologically, Bitcoin Core developers have rolled out significant upgrades, including further optimizations to Taproot, enhancing privacy and scalability. The SHA-256 mining algorithm remains robust, though debates around Bitcoin energy consumption persist, driving innovation in renewable-powered mining operations. The Lightning Network has seen exponential growth, reducing transaction costs and improving speed—key factors in Bitcoin’s evolution as a medium of exchange.

From a community perspective, the ethos of Satoshi Nakamoto’s vision remains strong, with decentralized governance and open-source development at the core. However, regulatory scrutiny has intensified, particularly around Bitcoin tokenomics and compliance standards. Analysts are closely watching Bitcoin dominance in the broader crypto markets, as altcoins and blockchain innovations compete for attention.

For investors and enthusiasts, keeping an eye on Bitcoin statistics—such as hash rate, wallet adoption, and on-chain metrics—is crucial. The Bitcoin roadmap suggests further scaling solutions, while the Bitcoin to USD chart reflects macroeconomic influences, including inflation hedging and geopolitical shifts. Whether you're a miner, trader, or long-term holder, understanding these trends is essential for navigating the ever-evolving Bitcoin markets in 2025.

Key takeaways for 2025:

- Institutional players like BlackRock and MicroStrategy are deepening Bitcoin integration.

- Technological advancements (Taproot, Lightning Network) are improving scalability and efficiency.

- Regulatory developments could shape adoption and market stability.

- Mining innovations are addressing energy concerns while maintaining network security.

- Global adoption (e.g., El Salvador) continues to test Bitcoin’s real-world utility.

For those tracking Bitcoin news, the interplay between technology, regulation, and market behavior will define the next phase of growth. Whether through self-custody in Bitcoin wallets or participation in mining pools, engagement with the ecosystem has never been more dynamic.

Professional illustration about Binance

How Bitcoin Mining Works

How Bitcoin Mining Works

Bitcoin mining is the backbone of the Bitcoin network, ensuring security, decentralization, and the creation of new BTC through a process called proof-of-work (PoW). At its core, mining involves solving complex mathematical puzzles using the SHA-256 algorithm to validate transactions and add them to the blockchain. Miners compete to find the correct hash, and the first to solve it earns the right to add the next block, receiving a block reward (currently 3.125 BTC as of 2025 after the latest halving) plus transaction fees.

The mining process begins when transactions are broadcast to the network and grouped into a mempool. Miners select transactions, prioritize those with higher fees (like those processed via the Lightning Network for speed), and bundle them into a candidate block. They then repeatedly hash the block header, adjusting a nonce (a random number) until the resulting hash meets the network’s difficulty target. This target adjusts every 2,016 blocks to maintain a 10-minute average block time, ensuring stability regardless of fluctuations in mining power.

Key Players and Innovations

Companies like MicroStrategy and BlackRock have spotlighted Bitcoin’s value, but miners remain the unsung heroes. Large-scale operations use ASIC (Application-Specific Integrated Circuit) rigs optimized for SHA-256, while smaller miners often pool resources via platforms like Binance Pool or Coinbase Cloud. Innovations like Taproot have streamlined transaction efficiency, reducing the computational load for miners. Meanwhile, nations like El Salvador (the first country to adopt BTC as legal tender) are exploring geothermal-powered mining to address concerns about Bitcoin energy consumption.

Economics and Challenges

Mining profitability hinges on three factors: Bitcoin price, electricity costs, and hardware efficiency. For example, a miner in Texas paying $0.05/kWh might outperform one in Germany paying $0.30/kWh, even with identical equipment. The Bitcoin roadmap includes ongoing debates about scaling solutions, with the Bitcoin Core team advocating for layer-2 networks like the Lightning Network to reduce on-chain congestion.

Fun Fact: The pseudonymous creator Satoshi Nakamoto mined the first Bitcoin block (the "genesis block") in 2009, embedding a headline about bank bailouts as a nod to Bitcoin’s anti-inflationary ethos. Today, mining has evolved into a multi-billion-dollar industry, with institutional players like BlackRock entering the space via Bitcoin ETFs, further legitimizing the asset class.

Environmental Considerations

Critics often highlight Bitcoin’s energy use, but the narrative is shifting. Nearly 60% of mining now uses renewable energy, per 2025 data, and initiatives like methane-capture mining are turning waste into value. The Bitcoin community is also exploring alternative consensus mechanisms, though PoW remains dominant due to its unparalleled security—a feature that’s cemented BTC’s market dominance despite newer cryptocurrency competitors.

For aspiring miners, joining a mining pool (like those offered by Binance or F2Pool) is often the best entry point, as solo mining requires prohibitive upfront costs. Tools like Bitcoin wallets with mining integration (e.g., Wasabi Wallet) can streamline payouts, while staying updated on Bitcoin news ensures adaptability to regulatory or technological shifts. Whether you’re a hobbyist or a corporate miner, understanding these mechanics is crucial for navigating the volatile yet rewarding world of Bitcoin mining.

Professional illustration about Blockchain

Bitcoin vs. Altcoins

Bitcoin vs. Altcoins: The Ultimate Showdown in 2025

The cryptocurrency landscape in 2025 remains dominated by Bitcoin (BTC), but the rise of altcoins has created a dynamic and competitive market. While Bitcoin continues to be the gold standard of blockchain technology, altcoins like Ethereum, Solana, and Binance Coin offer unique value propositions, from smart contracts to faster transaction speeds. However, Bitcoin's unparalleled market dominance, institutional adoption by giants like BlackRock and MicroStrategy, and its status as a store of value keep it in a league of its own.

One key differentiator is Bitcoin's decentralized nature, rooted in Satoshi Nakamoto's original vision. Unlike many altcoins, which often have centralized development teams or corporate backing (e.g., Binance with BNB), Bitcoin Core is maintained by a global Bitcoin community of developers. This decentralization ensures resilience against manipulation, a trait that resonates with long-term investors. Meanwhile, altcoins frequently pivot their roadmaps to chase trends, leading to volatility. For example, while some altcoins boast lower fees, Bitcoin's Lightning Network has made significant strides in 2025, enabling near-instant, low-cost transactions without compromising security.

Energy consumption and mining efficiency also set Bitcoin apart. Critics often highlight its SHA-256 proof-of-work mechanism as energy-intensive, but advancements in renewable energy mining and the Taproot upgrade have improved sustainability. In contrast, many altcoins use proof-of-stake or hybrid models, which, while greener, sometimes sacrifice security for scalability. El Salvador's continued success with Bitcoin as legal tender further validates its real-world utility, whereas altcoins struggle to achieve similar mainstream adoption.

From an investment perspective, Bitcoin'stokenomics—capped at 21 million coins—create inherent scarcity, driving its price appreciation over time. Altcoins, however, often face inflationary pressures due to unlimited supplies or frequent token burns. Institutional players like Coinbase and BlackRock prioritize Bitcoin in their portfolios, signaling confidence in its long-term value. That said, altcoins can offer higher short-term gains, appealing to traders who capitalize on market cycles.

For newcomers, the choice between Bitcoin and altcoins boils down to risk tolerance and goals. Bitcoin is the safer bet for preserving wealth, while altcoins can diversify a portfolio if researched thoroughly. Always store assets in secure Bitcoin wallets and stay updated with Bitcoin news to navigate this ever-evolving space.

Professional illustration about Cryptocurrency

Bitcoin Security Tips

Bitcoin Security Tips: Protecting Your BTC in 2025

In the fast-evolving world of cryptocurrency, securing your Bitcoin (BTC) holdings is more critical than ever. With institutional players like MicroStrategy, BlackRock, and Coinbase doubling down on Bitcoin adoption, the stakes are high for individual investors. Here’s how to safeguard your digital assets in 2025, leveraging the latest blockchain advancements and avoiding common pitfalls.

1. Use a Hardware Wallet for Cold Storage

The golden rule of Bitcoin security is to keep the majority of your holdings offline. Hardware wallets like Ledger or Trezor remain the gold standard for cold storage, isolating your private keys from internet-connected devices. For context, MicroStrategy, which holds over 200,000 BTC, relies on multi-signature cold storage solutions. If you’re holding significant amounts of BTC, consider splitting your funds across multiple wallets to mitigate risk.

2. Enable Multi-Signature (Multi-Sig) Authentication

Multi-signature wallets require approvals from multiple private keys to authorize transactions. This is especially useful for businesses or families managing shared Bitcoin assets. Platforms like Coinbase and Binance offer institutional-grade multi-sig solutions, but self-custody options like Bitcoin Core or Electrum also support this feature.

3. Stay Updated on Network Upgrades

The Bitcoin protocol continues to evolve, with upgrades like Taproot enhancing privacy and scalability. Ensure your wallet software supports these updates to benefit from improved security features. For example, Taproot makes complex transactions (like those on the Lightning Network) indistinguishable from regular ones, reducing the risk of targeted attacks.

4. Beware of Phishing and Social Engineering

Scammers are getting smarter, impersonating Bitcoin exchanges like Binance or wallet providers via fake emails and websites. Always verify URLs manually and enable two-factor authentication (2FA) using an app like Google Authenticator—never SMS, which is vulnerable to SIM-swapping. Remember, Satoshi Nakamoto didn’t design Bitcoin to be stolen by a convincing email!

5. Diversify Your Storage Solutions

Don’t put all your BTC in one place. Combine hardware wallets, paper wallets (stored in fireproof safes), and even encrypted USB drives. El Salvador, the first country to adopt Bitcoin as legal tender, uses a mix of cold storage and custodial solutions for its national reserves.

6. Monitor Mining and Network Health

While individual miners might not impact Bitcoin’s SHA-256 security directly, understanding mining trends can help you gauge network robustness. In 2025, watch for shifts in mining hash rate or energy consumption—signs of potential centralization risks. Tools like mempool.space provide real-time transaction data to spot anomalies.

7. Leverage the Lightning Network for Small Transactions

For day-to-day spending, the Lightning Network offers faster, cheaper transactions without exposing your main Bitcoin holdings. Wallets like Phoenix or Breez simplify Lightning usage while maintaining security through channel backups.

8. Regularly Audit Your Security Practices

Revisit your security setup quarterly. Test wallet recovery phrases, check for firmware updates on hardware devices, and review access permissions for any third-party services (e.g., Coinbase or Binance API keys). The Bitcoin community thrives on transparency—learn from high-profile breaches to avoid repeating mistakes.

9. Understand Tax and Regulatory Risks

In 2025, regulators are cracking down on cryptocurrency compliance. Platforms like BlackRock’s spot Bitcoin ETF require KYC, but self-custodied wallets don’t. Balance privacy with legal obligations—consult a tax professional to avoid missteps.

10. Educate Yourself Continuously

Follow Bitcoin news from trusted sources (not Twitter randoms!). Dive into Bitcoin technology whitepapers, join developer forums, and track Bitcoin market cycles to anticipate security trends. Knowledge is your best defense in this decentralized ecosystem.

By adopting these practices, you’ll align with the security standards of giants like MicroStrategy while keeping your BTC safe from 2025’s threats. Whether you’re a miner, trader, or HODLer, proactive measures are the key to surviving—and thriving—in the Bitcoin economy.

Bitcoin Wallet Guide

Choosing the Right Bitcoin Wallet in 2025

With Bitcoin’s price continuing to break records and institutional players like MicroStrategy, BlackRock, and Coinbase doubling down on BTC, securing your cryptocurrency has never been more critical. A Bitcoin wallet is your gateway to the blockchain, allowing you to store, send, and receive BTC safely. But not all wallets are created equal—here’s how to pick the best one for your needs in 2025.

Types of Bitcoin Wallets: Security vs. Convenience

- Hardware Wallets (Cold Storage) – The gold standard for security, devices like Ledger or Trezor keep your private keys offline, making them immune to hacking. Ideal for long-term HODLers or large amounts of BTC.

- Software Wallets (Hot Wallets) – Apps like Bitcoin Core or Electrum offer a balance of security and accessibility. Great for daily transactions but vulnerable to malware if not properly secured.

- Mobile Wallets – Lightweight options like Trust Wallet or BlueWallet support the Lightning Network, enabling instant, low-fee payments. Perfect for users in El Salvador, where Bitcoin is legal tender.

- Exchange Wallets – Platforms like Binance or Coinbase provide built-in wallets, but leaving your BTC on an exchange means you don’t control your keys. Only use these for active trading.

Key Features to Look For in 2025

- Taproot Support: Ensures smarter, more private transactions on the Bitcoin network.

- Multi-Signature Security: Requires multiple approvals for transactions, reducing theft risks.

- SHA-256 Encryption: The same algorithm used in Bitcoin mining to protect your wallet’s integrity.

- Seed Phrase Backup: A 12-24 word recovery phrase is non-negotiable—lose it, and your BTC is gone forever.

Pro Tips for Wallet Management

- Diversify Storage: Split holdings between a hardware wallet (for savings) and a mobile wallet (for spending).

- Stay Updated: Wallet software evolves—regular updates ensure compatibility with the latest Bitcoin technology, like Taproot or Lightning.

- Beware of Scams: Fake wallet apps still plague app stores. Always download from official sources.

The Future of Bitcoin Wallets

As Satoshi Nakamoto’s vision matures, wallets are becoming more user-friendly without sacrificing security. Expect deeper integration with decentralized finance (DeFi) and AI-driven threat detection in the coming years. Whether you’re a miner, trader, or just stacking sats, your choice of wallet could mean the difference between thriving in the Bitcoin market cycles or becoming another cautionary tale.

Bitcoin Price Predictions

Bitcoin Price Predictions in 2025: What Experts Are Saying

The Bitcoin price remains one of the most debated topics in the cryptocurrency world, with analysts weighing in on everything from Bitcoin market cycles to institutional adoption. As of 2025, BTC has shown resilience despite macroeconomic pressures, with predictions ranging from conservative estimates of $100,000 to bullish forecasts surpassing $250,000. Companies like MicroStrategy continue to double down on their holdings, signaling long-term confidence, while institutional players like BlackRock and Coinbase have further legitimized Bitcoin as a store of value.

One key factor influencing Bitcoin price predictions is the Bitcoin mining landscape. The SHA-256 algorithm remains the backbone of the network, but advancements like the Lightning Network and Taproot upgrade have improved scalability, making transactions faster and cheaper. El Salvador’s continued embrace of BTC as legal tender has also kept adoption in the spotlight, though critics point to Bitcoin energy consumption as a lingering concern. Meanwhile, exchanges like Binance report steady demand, with Bitcoin dominance hovering around 45%—proof that BTC still leads the blockchain revolution.

Technical and Fundamental Drivers

From a technical standpoint, the Bitcoin to USD chart reveals patterns tied to halving events, with the next one expected in 2028. Historically, these events trigger supply shocks, pushing prices upward. Analysts also monitor Bitcoin tokenomics, particularly the fixed supply of 21 million coins, which creates scarcity. On-chain data from Bitcoin Core shows declining exchange reserves, suggesting holders are opting for long-term storage in Bitcoin wallets rather than short-term trading.

Fundamentally, the Bitcoin community remains divided on short-term volatility. Some point to Bitcoin statistics like the growing hash rate (a measure of network security) as bullish indicators, while others warn of regulatory risks. The Bitcoin roadmap includes further optimizations to reduce fees and energy use, which could attract more institutional capital. For retail investors, tools like dollar-cost averaging (DCA) are often recommended to navigate Bitcoin markets without timing the peaks and valleys.

Wild Cards: Satoshi Nakamoto’s Legacy and Macro Trends

No discussion about Bitcoin price predictions is complete without acknowledging the wild cards. The mysterious creator, Satoshi Nakamoto, still holds an estimated 1 million BTC, and any movement from those wallets could send shockwaves through the market. Geopolitical instability and inflation fears also play a role, as BTC is increasingly seen as "digital gold." While no one can predict the exact Bitcoin price in 2025, the combination of technological progress, institutional interest, and macroeconomic trends suggests that Bitcoin news will continue to dominate financial headlines for years to come.

Bitcoin Tax Rules

Understanding Bitcoin Tax Rules in 2025

Navigating Bitcoin tax rules in 2025 requires a clear grasp of how governments classify cryptocurrency transactions. The IRS treats Bitcoin (BTC) as property, meaning every sale, trade, or use of BTC for goods/services triggers a taxable event. For example, if you bought 1 BTC at $30,000 and sold it at $50,000, you’d owe capital gains tax on the $20,000 profit. Even swapping BTC for another cryptocurrency on platforms like Binance or Coinbase is considered a taxable exchange.

Key Tax Scenarios to Watch

- Mining Rewards: If you’re part of the Bitcoin mining community, the fair market value of mined BTC at receipt is taxable as ordinary income. Mining pools using SHA-256 algorithms must report these earnings, and subsequent sales incur capital gains/losses.

- Staking and Node Operations: Running a Bitcoin Core node or earning via the Lightning Network? Rewards are taxable upon receipt, similar to mining. The Bitcoin community often debates the fairness of this, but the IRS hasn’t budged.

- Corporate Holdings: Companies like MicroStrategy and BlackRock must report Bitcoin holdings on balance sheets, with mark-to-market tax implications. MicroStrategy’s massive BTC purchases, for instance, are scrutinized for capital gains during quarterly revaluations.

Global Variations and Compliance

While the U.S. follows strict crypto tax guidelines, other regions like El Salvador (where Bitcoin is legal tender) have unique rules. Salvadoran businesses accepting BTC pay taxes based on the USD equivalent at the time of transaction. Meanwhile, the Bitcoin markets in Europe often follow VAT exemptions for crypto-to-crypto trades but tax fiat conversions.

Record-Keeping and Tools

Given Bitcoin’s price volatility, maintaining detailed records is non-negotiable. Use blockchain explorers to track transaction histories or wallets like those supporting Taproot upgrades for enhanced privacy. Services like Coinbase provide tax documents, but self-custody wallets require manual logging. Pro tip: The Bitcoin roadmap includes improvements like Schnorr signatures, which could simplify tax tracking for multisig transactions.

Audit Risks and Strategic Planning

The IRS has ramped up crypto audits, focusing on high-volume traders and Bitcoin dominance in portfolios. If you’ve traded BTC during Bitcoin market cycles, ensure Form 8949 aligns with your Bitcoin to USD chart history. Long-term holders benefit from lower capital gains rates (held over a year), while day traders face short-term rates.

Final Considerations

The Bitcoin tokenomics model—capped at 21 million coins—means scarcity drives value, but tax obligations remain unavoidable. Whether you’re a Satoshi Nakamoto purist or a Binance power user, staying compliant in 2025 means merging blockchain transparency with meticulous tax reporting. Keep an eye on Bitcoin news for regulatory shifts, especially as institutions like BlackRock push for clearer guidelines.

Bitcoin for Beginners

If you're new to Bitcoin (BTC), the world's first decentralized cryptocurrency, here's everything you need to know to get started. Created in 2009 by the mysterious Satoshi Nakamoto, Bitcoin operates on a blockchain—a public ledger that records all transactions without needing a central authority like a bank. Unlike traditional money, Bitcoin is digital, borderless, and limited to just 21 million coins, making it a deflationary asset.

At its core, Bitcoin relies on SHA-256, a cryptographic algorithm that secures transactions. Mining is the process where powerful computers solve complex math problems to validate transactions and add them to the blockchain. Miners are rewarded with newly minted BTC, but as of 2025, the reward has halved multiple times due to Bitcoin's built-in scarcity mechanism. The Lightning Network, a second-layer solution, speeds up transactions and reduces fees, making Bitcoin more practical for everyday use.

Major exchanges like Binance, Coinbase, and Kraken allow beginners to buy BTC with fiat currency. Once purchased, storing Bitcoin securely is crucial. Options include:

- Hot wallets (connected to the internet, convenient for frequent trading)

- Cold wallets (offline storage like hardware wallets, best for long-term holding)

- Custodial wallets (managed by exchanges, but less secure than self-custody)

Institutions like BlackRock and MicroStrategy have heavily invested in Bitcoin, signaling growing mainstream adoption. Even countries like El Salvador have made BTC legal tender, proving its real-world utility.

Bitcoin's price is highly volatile, influenced by factors like market dominance, adoption trends, and macroeconomic conditions. Checking the Bitcoin to USD chart can help beginners track price movements, but long-term investors often focus on Bitcoin tokenomics—its fixed supply and increasing demand. Historically, Bitcoin goes through market cycles, with bull runs followed by corrections, making dollar-cost averaging (DCA) a smart strategy.

The Bitcoin Core development team continuously improves the network. Recent upgrades like Taproot enhance privacy and scalability, ensuring Bitcoin remains competitive. Meanwhile, debates around Bitcoin energy consumption persist, though many miners now use renewable energy to address sustainability concerns.

Engaging with the Bitcoin community through forums, social media, and events can deepen your understanding. Staying updated with Bitcoin news and developments—like institutional adoption or regulatory changes—helps beginners make informed decisions. Whether you're interested in trading, investing, or simply learning, Bitcoin offers endless opportunities in 2025’s fast-evolving financial landscape.

Bitcoin ETFs Explained

Bitcoin ETFs Explained

Bitcoin ETFs (Exchange-Traded Funds) have revolutionized how traditional investors gain exposure to BTC without directly holding the cryptocurrency. By 2025, major financial institutions like BlackRock and MicroStrategy have further legitimized Bitcoin as an asset class, with ETFs offering a regulated, low-barrier entry point. These funds track Bitcoin price movements, allowing investors to trade shares on stock exchanges just like traditional equities—eliminating the need for Bitcoin wallets or navigating exchanges like Binance or Coinbase.

The approval of spot Bitcoin ETFs in early 2024 marked a turning point, as they hold actual BTC instead of derivatives. This shift reduced counterparty risk and boosted institutional adoption. For example, BlackRock's iShares Bitcoin Trust (IBIT) quickly became one of the most traded ETFs, reflecting growing demand. Meanwhile, MicroStrategy continued its aggressive Bitcoin accumulation strategy, holding over 1% of the total supply, further validating the asset's scarcity.

How Bitcoin ETFs Work

Bitcoin ETFs function similarly to gold or S&P 500 ETFs but are tied to Bitcoin's market cycles. Custodians like Coinbase secure the underlying BTC, while the ETF issuer handles regulatory compliance. Investors benefit from:

- Liquidity: Easily buy/sell shares without dealing with blockchain transactions.

- Tax Efficiency: ETFs often provide clearer tax reporting than direct cryptocurrency holdings.

- Security: Avoids risks associated with self-custody, such as phishing or exchange hacks.

However, critics argue that ETFs centralize Bitcoin ownership, contradicting Satoshi Nakamoto's vision of decentralization. Others highlight Bitcoin energy consumption concerns, as mining (powered by SHA-256) remains integral to network security.

The Role of Institutions

The rise of Bitcoin ETFs has intensified Bitcoin dominance in the crypto markets. BlackRock's involvement signaled to Wall Street that BTC is here to stay, while countries like El Salvador (which adopted Bitcoin as legal tender in 2021) demonstrated its macroeconomic utility. The Lightning Network and Taproot upgrades further improved scalability, making Bitcoin more viable for everyday transactions—a factor ETFs indirectly support by increasing mainstream adoption.

For investors, understanding Bitcoin tokenomics is crucial. With a fixed supply of 21 million coins, ETFs amplify demand-side pressure, potentially driving long-term price appreciation. Meanwhile, the Bitcoin Core development team continues refining the protocol, ensuring its resilience amid growing institutional interest.

Final Considerations

While Bitcoin ETFs simplify access, they come with management fees (typically 0.2%-1.5%) and may lag behind real-time Bitcoin to USD chart movements due to settlement processes. Active traders might still prefer direct exposure via exchanges, but for retirement accounts or passive investors, ETFs offer a compelling alternative. As Bitcoin mining adapts to renewable energy solutions and regulatory clarity improves, ETFs will likely remain a cornerstone of crypto investment strategies in 2025 and beyond.

For those tracking Bitcoin statistics, ETF inflows/outflows now serve as a key metric for institutional sentiment, alongside on-chain data like wallet growth and Bitcoin community engagement. Whether you're a long-term holder or a newcomer, understanding ETFs is essential in today's evolving financial landscape.

Bitcoin Halving Impact

The Bitcoin Halving Impact in 2025: What You Need to Know

The Bitcoin halving is one of the most anticipated events in the cryptocurrency world, and its impact reverberates across Bitcoin markets, mining operations, and institutional adoption. Scheduled to occur roughly every four years, the halving cuts the block reward for Bitcoin miners in half, reducing the rate at which new BTC enters circulation. The 2025 halving will slash rewards from 3.125 BTC to 1.5625 BTC, further tightening supply—a key factor in Bitcoin's tokenomics. Historically, halvings have preceded major Bitcoin price rallies, as seen in 2012, 2016, and 2020, but the 2025 event unfolds in a vastly different landscape dominated by institutional players like BlackRock, MicroStrategy, and regulated exchanges such as Coinbase and Binance.

Mining Economics Post-Halving

The halving directly impacts Bitcoin mining profitability, as miners now earn half the rewards for the same computational work. This puts pressure on operations relying on older hardware or higher energy costs, potentially forcing less efficient miners offline. However, advancements in SHA-256 ASIC miners and the growing adoption of renewable energy could offset some of these challenges. Miners may also turn to secondary revenue streams, like leveraging the Lightning Network for transaction fees or participating in Blockchain-based services. Companies like MicroStrategy, which heavily invests in BTC, often view the halving as a long-term bullish signal, doubling down on accumulation strategies despite short-term volatility.

Institutional Influence and Market Dynamics

Technological and Community Developments

The Bitcoin Core development team continues refining the network, with upgrades like Taproot enhancing scripting capabilities and privacy. The Bitcoin community remains fiercely decentralized, staying true to Satoshi Nakamoto's vision while adapting to modern needs. Post-halving, expect heightened discussions around Bitcoin roadmap priorities, such as scaling solutions and wallet security. For traders, monitoring the Bitcoin to USD chart around halving events is critical, as historical patterns suggest increased volatility followed by potential upward trends.

Practical Takeaways for Investors and Miners

For miners, optimizing operations with efficient hardware and low-cost energy is essential post-halving. Investors should watch institutional inflows (via BlackRock, Coinbase, etc.) and macroeconomic trends, as these factors now play a larger role in Bitcoin price action than in past cycles. Long-term holders might see the halving as an opportunity, given Bitcoin's deflationary design, while short-term traders should brace for volatility. The 2025 halving isn’t just a supply event—it’s a stress test for Bitcoin's resilience in an era of Wall Street adoption and global scalability challenges.

Bitcoin Adoption Growth

Bitcoin adoption growth has accelerated dramatically in 2025, with institutional and retail investors alike recognizing its potential as both a store of value and a medium of exchange. Companies like MicroStrategy continue to double down on their BTC holdings, with CEO Michael Saylor recently announcing an additional $500 million purchase, bringing their total stash to over 250,000 BTC. Meanwhile, major financial players like BlackRock have expanded their Bitcoin ETF offerings, making it easier than ever for traditional investors to gain exposure. Exchanges such as Binance and Coinbase report record-breaking trading volumes, signaling heightened mainstream interest.

One of the biggest drivers of adoption is the continued improvement in Bitcoin technology. The Lightning Network, for instance, has seen a 300% increase in capacity since 2024, enabling near-instant, low-cost transactions that make BTC viable for everyday purchases. Taproot, Bitcoin’s most significant upgrade in years, has further enhanced privacy and scalability, making the blockchain more efficient. Developers within the Bitcoin Core team remain committed to refining the protocol, ensuring it stays ahead of regulatory and technological challenges.

El Salvador, the first country to adopt Bitcoin as legal tender, continues to lead the charge in nationwide adoption. The government has expanded its mining operations using volcanic geothermal energy, addressing concerns about Bitcoin energy consumption. Other nations are taking note, with at least three more countries rumored to be considering similar moves in 2025. Meanwhile, grassroots adoption is thriving, with businesses worldwide—from coffee shops to real estate agencies—now accepting BTC payments.

The Bitcoin price has also played a crucial role in adoption, with its resilience during market downturns reinforcing its reputation as "digital gold." Analysts point to Bitcoin market cycles suggesting that the current bull run, fueled by institutional inflows, could push prices to new all-time highs. Bitcoin dominance in the cryptocurrency space remains strong, hovering around 50%, as investors prioritize its proven security (thanks to SHA-256 encryption) and decentralized nature over newer, untested altcoins.

For those looking to participate in Bitcoin adoption, here are some practical steps:

- Use self-custody wallets to take full control of your BTC instead of relying solely on exchanges.

- Explore Lightning Network apps for fast, cheap micropayments—perfect for tipping creators or buying small items.

- Stay informed on Bitcoin news, particularly regulatory developments, as governments worldwide refine their stance on cryptocurrency.

- Consider mining if you have access to cheap renewable energy, though profitability depends heavily on hardware efficiency and electricity costs.

The Bitcoin community remains one of its strongest assets, with developers, miners, and hodlers all contributing to its growth. Whether through technological innovation, financial infrastructure, or grassroots adoption, Bitcoin is steadily cementing its place in the global economy. And while Satoshi Nakamoto’s original vision of a peer-to-peer electronic cash system evolves, the fundamentals—decentralization, scarcity, and security—remain unchanged, ensuring BTC stays at the forefront of the digital currency revolution.

Bitcoin Scams to Avoid

Bitcoin Scams to Avoid in 2025

The rapid growth of Bitcoin adoption—fueled by institutional players like BlackRock, MicroStrategy, and Coinbase—has unfortunately also led to a surge in sophisticated scams targeting both new and experienced investors. Whether you're trading on Binance, mining BTC using SHA-256, or simply holding in a Bitcoin wallet, staying vigilant is critical. Here’s a breakdown of the most common Bitcoin scams to watch out for and how to protect yourself.

1. Fake Exchanges and Phishing Sites

Scammers often create clone websites mimicking reputable platforms like Binance or Coinbase, complete with fake login pages to steal credentials. Always verify the URL (look for HTTPS) and enable two-factor authentication (2FA). Be wary of ads promoting "too-good-to-be-true" trading bonuses—legitimate exchanges like Coinbase rarely offer unrealistic deals.

2. Ponzi Schemes and Fake Investment Platforms

With Bitcoin's price volatility, many fraudsters promise guaranteed returns through "cloud mining" or "AI trading bots." Remember: if a platform claims you’ll double your BTC overnight, it’s likely a scam. Even high-profile projects can collapse, as seen with past schemes that exploited Bitcoin market cycles. Stick to verified platforms like BlackRock’s Bitcoin ETF or regulated services.

3. Impersonation Scams (Fake Elon Musk, Satoshi Nakamoto, or Bitcoin Core Devs)

Scammers impersonate celebrities or Bitcoin Core developers on social media, urging followers to send BTC to a "giveaway" address. No legitimate figure—not even Satoshi Nakamoto—will ask for your cryptocurrency. Always cross-check announcements with official sources like the Bitcoin Core GitHub or verified Twitter accounts.

4. Malware Targeting Bitcoin Wallets and Private Keys

Malicious software can infiltrate your device to steal Bitcoin wallet credentials or replace wallet addresses during transactions (a clipboard hijack). Use hardware wallets for large holdings and avoid downloading suspicious files, especially if you’re active in the Bitcoin community forums.

5. Fake Mining Pools and Cloud Mining Scams

With Bitcoin mining becoming more competitive, some fraudsters lure victims into fake mining pools that never pay out. Research any pool’s reputation and fees thoroughly. Legitimate operations are transparent about their SHA-256 hashrate and payout structures.

6. Rug Pulls in the Lightning Network and Taproot Projects

The Lightning Network and Taproot upgrades have spurred innovation, but they’ve also attracted shady developers who abandon projects after collecting funds. Before investing in a Blockchain startup, audit its team, roadmap, and tokenomics. Check if their code is open-source and reviewed by the Bitcoin community.

7. Government and Fake Regulatory Scams

As countries like El Salvador adopt BTC, scammers pose as tax authorities or regulators demanding Bitcoin payments for "fines" or "verification." Real agencies will never ask for cryptocurrency—report these attempts immediately.

8. Fake News Manipulating Bitcoin Price

Fraudsters spread false rumors (e.g., BlackRock abandoning BTC) to trigger panic selling or buying. Always verify Bitcoin news across multiple trusted sources like Coinbase’s blog or Bitcoin Core announcements.

Pro Tips to Stay Safe

- Use wallets that support Taproot for enhanced security.

- Monitor Bitcoin dominance trends to spot unusual market activity.

- Never share private keys or seed phrases—even with "support agents."

- Bookmark official sites (e.g., Binance, Coinbase) to avoid phishing.

By understanding these scams and leveraging Bitcoin technology responsibly, you can navigate the ecosystem safely. Stay skeptical, do your research, and remember: in the cryptocurrency world, if something feels off, it probably is.

Bitcoin Trading Strategies

Bitcoin Trading Strategies for 2025: From HODLing to Advanced Techniques

Whether you're a long-term believer in Bitcoin's store-of-value proposition or an active trader capitalizing on Bitcoin market cycles, having a clear strategy is critical. In 2025, the cryptocurrency landscape has evolved, with institutional players like BlackRock and MicroStrategy doubling down on BTC while innovations like Taproot and the Lightning Network improve scalability. Here’s a breakdown of proven Bitcoin trading strategies to navigate this dynamic ecosystem.

1. The HODL Strategy: Long-Term Accumulation

The simplest approach? Buy and hold. Inspired by Satoshi Nakamoto’s vision, this strategy involves accumulating Bitcoin regardless of short-term price fluctuations. Companies like MicroStrategy have adopted this, treating BTC as a treasury reserve asset. Key tips:

- Dollar-cost averaging (DCA): Regularly invest fixed amounts (e.g., monthly) to mitigate volatility.

- Secure storage: Use cold wallets or trusted custodians like Coinbase Institutional for large holdings.

- Monitor Bitcoin tokenomics: With the 2024 halving behind us, reduced supply inflation could drive long-term appreciation.

2. Swing Trading: Capitalizing on Market Cycles

For those comfortable with technical analysis, swing trading exploits Bitcoin’s price swings within broader trends. Tools to leverage:

- Support/resistance levels: Identify key price zones using Bitcoin to USD charts.

- On-chain metrics: Track exchange flows (e.g., Binance reserves) to gauge selling pressure.

- Macro trends: Institutional adoption (e.g., BlackRock’s spot ETF inflows) often fuels multi-month rallies.

3. Scalping with Lightning Network Efficiency

High-frequency traders can exploit Bitcoin’s intraday volatility using the Lightning Network for near-instant, low-fee transactions. For example:

- Arbitrage opportunities: Price discrepancies across exchanges like Binance and Coinbase can be exploited if execution is fast.

- Pair with SHA-256 mining data: Hash rate spikes sometimes precede price movements.

4. Hedging Strategies for Institutional Players

With Bitcoin’s correlation to traditional markets fluctuating, institutions use derivatives to hedge:

- Options on Coinbase or CME: Protect against downside while retaining upside.

- Blockchain-based analytics: Platforms like Glassnode help identify overbought/oversold conditions.

5. Mining-Based Strategies (For Advanced Traders)

Bitcoin mining isn’t just for earning block rewards—it’s a trading signal. In 2025:

- Miner capitulation: When hash rate drops sharply, it often signals local price bottoms.

- Energy-cost arbitrage: Miners in regions like El Salvador (with geothermal energy) have a competitive edge, affecting BTC supply dynamics.

Final Pro Tips

- Stay updated on Bitcoin Core upgrades (e.g., Taproot enhances privacy for transactions).

- Watch regulatory shifts: BlackRock’s involvement could bring tighter oversight.

- Diversify timing: Combine DCA with swing trades to balance risk.

Remember, no strategy is foolproof—Bitcoin’s volatility demands discipline. Whether you’re tracking Bitcoin dominance or experimenting with Lightning Network micropayments, adaptability is key in 2025’s fast-moving markets.

Bitcoin Regulation Updates

Bitcoin Regulation Updates in 2025: What Investors Need to Know

The regulatory landscape for Bitcoin continues to evolve rapidly in 2025, with governments and financial institutions grappling with how to balance innovation and oversight. In the U.S., the SEC's approval of BlackRock's spot BTC ETF in early 2024 set a precedent, but regulators are now scrutinizing cryptocurrency exchanges like Binance and Coinbase more closely. Recent enforcement actions focus on anti-money laundering (AML) compliance, with the Treasury Department proposing stricter reporting requirements for Bitcoin wallets holding over $10,000. Meanwhile, MicroStrategy's aggressive BTC acquisitions—now exceeding 250,000 BTC—have drawn attention to corporate treasury strategies, sparking debates about tax treatment and accounting standards.

Globally, El Salvador remains a pioneer, doubling down on its Bitcoin adoption by integrating the Lightning Network for faster, cheaper transactions. However, other nations are taking a more cautious approach. The EU’s Markets in Crypto-Assets (MiCA) framework, fully implemented in 2025, mandates transparency for blockchain projects, while China’s ban on mining has pushed operations to friendlier jurisdictions like Kazakhstan and Texas. Energy concerns persist, with critics targeting SHA-256 mining’s carbon footprint, though proponents highlight the growing use of renewable energy—now powering over 60% of the Bitcoin network, according to 2025 Bitcoin statistics.

For developers, Taproot upgrades and Bitcoin Core optimizations are making the network more efficient, but regulatory uncertainty looms. The Bitcoin community is divided on how to respond—some advocate for self-regulation, while others push for clearer guidelines to avoid stifling innovation. Key questions remain: Will Satoshi Nakamoto’s vision of decentralization survive increasing oversight? And how will Bitcoin markets react to potential crackdowns? One thing’s clear: staying informed about Bitcoin news and regulatory shifts is critical for anyone invested in the future of cryptocurrency.

Pro Tip: Monitor Bitcoin dominance and the Bitcoin to USD chart for signals of market sentiment shifts post-regulatory announcements. Diversifying across compliant platforms and cold storage Bitcoin wallets can mitigate risks as policies evolve.

Bitcoin Future Outlook

Bitcoin Future Outlook: Where Is BTC Heading in 2025 and Beyond?

The future of Bitcoin remains one of the most debated topics in the cryptocurrency space. With institutional adoption accelerating—thanks to players like BlackRock, MicroStrategy, and Coinbase—the Bitcoin price trajectory appears bullish in the long term. However, challenges like regulatory scrutiny, Bitcoin energy consumption, and scalability hurdles must be addressed.

Major financial institutions have doubled down on BTC in 2025, with BlackRock launching a spot Bitcoin ETF and MicroStrategy continuing its aggressive accumulation strategy (now holding over 1% of the total BTC supply). Meanwhile, exchanges like Binance and Coinbase are expanding custody solutions, signaling growing trust in Bitcoin markets. Historically, Bitcoin market cycles have followed a four-year pattern tied to halving events, and analysts predict the next bull run could push BTC beyond its previous all-time highs.

The Bitcoin Core development team remains focused on enhancing scalability and privacy. The Lightning Network has seen exponential growth, reducing transaction costs and speeding up micropayments. Additionally, the Taproot upgrade (implemented in 2021) continues to improve scripting flexibility, making Bitcoin technology more efficient for smart contracts. These innovations could solidify BTC’s position as both a store of value and a medium of exchange.

Regulation remains a wildcard. While El Salvador’s Bitcoin adoption experiment has shown mixed results, other nations are cautiously exploring blockchain-based financial systems. The SEC’s stance on Bitcoin tokenomics and mining operations could shape future adoption. Meanwhile, concerns over Bitcoin energy consumption have led to greener mining solutions, including hydro-powered farms and more efficient SHA-256 algorithms.

Despite Bitcoin dominance in the crypto space, competition from altcoins and central bank digital currencies (CBDCs) poses risks. However, BTC’s decentralized nature and fixed supply (capped at 21 million) give it an edge as "digital gold." Key metrics to watch include the Bitcoin to USD chart, mining difficulty adjustments, and wallet adoption rates. If the Bitcoin community continues to innovate while addressing scalability and environmental concerns, Satoshi Nakamoto’s vision of a peer-to-peer electronic cash system could become a global reality.

For investors and enthusiasts, staying updated on Bitcoin news, Bitcoin statistics, and protocol upgrades is crucial. Whether BTC evolves into a mainstream asset or remains a volatile yet high-reward investment depends on how these factors unfold in the coming years.