Professional illustration about Coinbase

Top $20 Sign-Up Bonuses

Looking for quick cash just for signing up? In 2025, dozens of fintech platforms, investment apps, and cashback rewards programs offer instant $20 sign-up bonuses—no strings attached. Whether you're into crypto trading, micro investing, or simple side hustles, here’s a breakdown of the top $20 sign-up bonuses you shouldn’t miss.

Crypto & Investment Platforms

Apps like Ibotta, Swagbucks, and BeFrugal are goldmines for earn money online opportunities. Scan receipts, complete quick tasks, or shop through their portals to snag your sign-up reward. Branded Surveys and InboxDollars pay $20+ for completing your first few surveys, making them perfect for online income seekers. Meanwhile, Cash App and PayPal sometimes offer free money apps promotions—just link your debit card or send a small payment to a friend to qualify. Banking & Financial Services

Traditional banks and student loan refinancing platforms are also jumping on the sign-up bonus bandwagon. Chime and Current often advertise $20 bonuses for direct deposits, while TD Bank and Chase may offer cash incentives for opening a new checking account. Albert, a budgeting app, occasionally rewards new users with $20 for connecting their accounts. These are low-effort ways to boost your personal finance game while pocketing extra cash. Maximizing Your Bonuses

To make the most of these offers, focus on platforms aligned with your goals. For example, if you’re into crypto, prioritize Crypto.com or Binance. If you prefer passive cashback rewards, Ibotta or Swagbucks might be better. Always verify the terms—some bonuses expire or require specific actions (like a minimum spend). Stacking multiple sign-up rewards can add up fast, turning a few minutes of effort into $100+ in free money. Just remember: Legitimate platforms like SoFi or PayPal will never ask for upfront fees to claim bonuses.

Whether you’re saving, investing, or just looking for

quick cash, these $20 sign-up bonuses are an easy way to pad your wallet in 2025. Keep an eye out for limited-time promotions, as platforms like Freecash and InboxDollars frequently update their offers. Happy earning!

Professional illustration about InboxDollars

Instant $20 Bonus Apps

Looking for

instant $20 bonus apps to pad your wallet with minimal effort? In 2025, fintech platforms and reward apps are rolling out competitive sign-up bonuses to attract users, making it easier than ever to earn quick cash just for joining. Whether you're into crypto trading, cashback rewards, or side hustles, there's an app tailored to your goals. Crypto and investment platforms like Binance, Coinbase, and Crypto.com frequently offer referral bonuses—sometimes even more than $20—for new users who fund their accounts or complete a trade. Meanwhile, stock investing apps like MooMoo and SoFi provide cash incentives for depositing funds or executing your first trade. If you prefer micro-investing, Acorns and E\TRADE occasionally run promotions for new sign-ups, though their bonuses may vary.For those focused on

earn money online strategies, survey platforms like Branded Surveys and Swagbucks reward users instantly for completing profiles or initial tasks. Cashback apps such as Ibotta and BeFrugal also dish out sign-up rewards when you scan your first receipt or make a qualifying purchase. Even traditional banks like Chase, TD Bank, and Chime have jumped on the bandwagon, offering free money apps promotions for opening checking or savings accounts—often with direct deposits or minimum balance requirements.Prepaid debit platforms like

Current and Albert are another great way to snag an instant $20 bonus, usually by linking an external account or receiving a direct deposit. And let’s not forget PayPal and Cash App, which sometimes run limited-time promotions for new users who send or receive money.Pro tip: Always read the fine print. Some

financial services require minimum deposits, transaction thresholds, or holding periods before you can cash out your bonus. Timing matters too—apps like InboxDollars and Freecash rotate their promotions, so check their latest offers before signing up. Whether you're refinancing student loans, trading crypto, or just hunting for cashback apps, 2025’s landscape is packed with opportunities to turn a simple sign-up into online income.

Professional illustration about SoFi

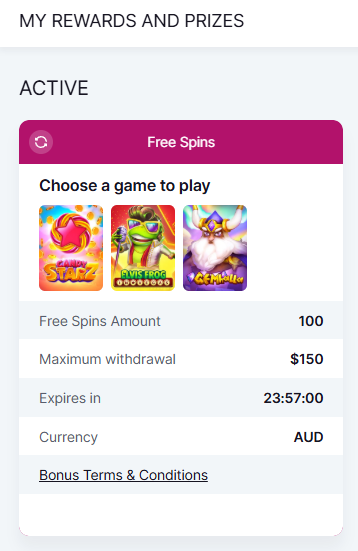

Best No-Deposit Offers

Looking for

no-deposit bonuses to score free money in 2025? You’re in luck—plenty of fintech platforms, cashback apps, and investment platforms offer instant $20 sign-up bonuses without requiring you to deposit a dime. These deals are perfect for side hustles, quick cash, or just padding your wallet with minimal effort. Crypto trading platforms like Binance and Coinbase frequently roll out referral bonuses for new users, often in the form of free crypto or cash rewards. For example, Crypto.com has been known to offer $25 in CRO tokens just for signing up and completing a simple verification process. Meanwhile, stock investing apps like MooMoo and SoFi sometimes provide free stocks or cash bonuses (think $10–$50) when you open an account—no deposit needed.If you prefer

cashback rewards, apps like Ibotta and Swagbucks are goldmines. Ibotta gives you a sign-up bonus (often $10–$20) just for scanning your first receipt, while Swagbucks rewards you with a $10 bonus after completing a few easy tasks like watching videos or taking surveys. Survey platforms like Branded Surveys and InboxDollars also offer no-deposit bonuses—usually $5–$10—just for signing up and completing your profile.For

micro-investing and personal finance tools, Acorns and Albert occasionally waive their monthly fees or offer cash bonuses for new users. Cash App and PayPal sometimes run promotions where you get $5–$20 for signing up and linking a debit card (no deposit required). Even traditional banks like Chase, TD Bank, and Chime have been known to offer no-deposit bonuses—Chime, for instance, has given away $100 just for setting up direct deposit, though some offers may require a small qualifying transaction. Pro Tip: Always read the fine print. Some no-deposit offers have hidden requirements, like completing a certain number of transactions or maintaining your account for a set period before the bonus unlocks. But if you’re strategic, these free money apps can be an easy way to boost your online income without risking your own cash.

Professional illustration about Swagbucks

Fastest Payout Platforms

If you're looking for the

fastest payout platforms to claim your instant $20 sign-up bonus, speed matters—especially when you need quick cash for side hustles or everyday expenses. In 2025, fintech platforms and cashback apps have streamlined payouts, but not all are created equal. Here’s a breakdown of the top performers: Cryptocurrency and Investment Platforms like Binance, Coinbase, and Crypto.com dominate for near-instant withdrawals. Binance processes crypto transfers in minutes, while Coinbase’s instant cashouts to PayPal or bank accounts take under 30 minutes—ideal for crypto trading pros. For stock investors, MooMoo and E*TRADE offer same-day settlements on referral bonuses, though bank transfers may take 1-2 business days. Cashback and Reward Apps are another speedy option. Ibotta and Swagbucks pay via PayPal within 24–48 hours after reaching thresholds (as low as $10). Freecash stands out for gaming rewards, with instant PayPal payouts for Gold members. Meanwhile, Branded Surveys and InboxDollars process cashouts in 3–5 days—slower but reliable for survey platforms. Banking and Fintech Apps excel for direct deposits. PayPal remains the gold standard for instant transfers (for a small fee), while Cash App and Chime deliver funds in seconds with their "Instant Transfer" features. SoFi and TD Bank offer next-day ACH transfers, and Current boosts payouts for direct deposits, often crediting paychecks up to two days early. Micro-Investing Apps like Acorns and Albert focus on long-term growth but have improved payout speeds. Acorns now processes withdrawals in 2–3 business days, while Albert’s "Instant" option sends cash to external accounts in minutes (with a fee). Chase and BeFrugal also offer rapid cashback redemptions—Chase Ultimate Rewards can be cashed out same-day if linked to a Chase account. Pro Tips for Faster Payouts**:- Link PayPal or a fintech account (like Cash App) to bypass traditional bank delays.

- Check for referral bonuses—platforms like Crypto.com or SoFi often expedite payouts for new users.

- Verify identity upfront to avoid verification holdups (common on Coinbase and Swagbucks).

- Opt for crypto withdrawals if possible—they’re typically faster than fiat transfers.

Whether you’re into stock investing, side hustles, or cashback rewards, prioritizing platforms with quick cash access ensures you’re not waiting weeks for your earnings. In 2025, blending fintech speed with strategic payout methods (like PayPal or instant crypto conversions) is the key to maximizing your online income.

Professional illustration about Acorns

Legit $20 Bonus Sites

Looking for legit $20 bonus sites in 2025? You’re in luck—plenty of fintech platforms, cashback apps, and investment platforms offer instant sign-up rewards just for joining. Whether you’re into crypto trading, micro investing, or simple side hustles, here’s a breakdown of the most reliable ways to pocket that extra cash.

Crypto and Investment Platforms

If you’re dipping your toes into stock investing or crypto trading, platforms like Binance, Coinbase, and Crypto.com frequently roll out referral bonuses for new users. For example, SoFi and MooMoo often promote limited-time sign-up bonuses for opening an account and funding it with a minimum deposit. Even traditional banks like TD Bank and Chase occasionally offer $20+ rewards for new checking or savings accounts—just watch out for fine print like minimum balance requirements.

Cashback and Reward Apps

Prefer earning quick cash through everyday spending? Apps like Ibotta, Swagbucks, and BeFrugal let you stack cashback rewards on groceries, online shopping, and even gas. PayPal and Cash App sometimes run promotions for new users who link a debit card or complete a small transaction. For a no-strings-attached approach, InboxDollars and Branded Surveys pay out free money for completing surveys or watching ads—though earnings are smaller, they’re a low-effort way to hit that $20 mark.

Micro-Investing and Banking Bonuses

Apps like Acorns and Albert blend personal finance tools with sign-up rewards, often matching your first deposit or offering bonuses for recurring investments. Neobanks like Chime and Current are also worth checking—they’ve been known to give $20+ for direct deposits or referrals. Meanwhile, ETRADE and similar investment platforms occasionally waive fees or add bonus cash for new accounts, especially if you’re moving assets from another broker.

Pro Tips for Maximizing Bonuses

- Read the terms: Many reward apps require a minimum activity (like a $10 purchase or survey completion) to unlock the bonus.

- Combine offers: Some platforms (e.g., Freecash) let you stack referral bonuses with other promotions.

- Act fast: Fintech platforms frequently update their offers, so set up alerts or join communities that track the latest deals.

Whether you’re refinancing student loans with SoFi or grinding through survey platforms, these legit $20 bonus sites can add up fast. Just stick to reputable names and avoid anything asking for upfront payments—your goal is earn money online, not lose it!

How to Claim Instantly

How to Claim Instantly

Claiming an instant $20 sign-up bonus is easier than you think—if you know the right steps. Whether you're using crypto trading platforms like Binance or Coinbase, cashback apps like Ibotta, or survey platforms like Branded Surveys, the process usually follows a similar pattern. Here’s a breakdown of how to secure your bonus fast across different categories:

Not all fintech platforms offer instant payouts. For example:

- Crypto.com and SoFi often credit bonuses within minutes after meeting requirements (like a minimum deposit).

- Cash App and PayPal may require linking a bank account or sending a small payment to trigger the reward.

- Survey apps like Swagbucks or InboxDollars might ask you to complete a quick task (e.g., signing up for a trial) before the $20 hits your account.

Pro tip: Always check the terms—some platforms, like Chime or Current, require direct deposit activation for banking bonuses.

Most sign-up rewards have simple hoops to jump through:

- Investment platforms like MooMoo or ETRADE may ask for an initial deposit (e.g., $100) to unlock the bonus.

- Micro-investing apps like Acorns or Albert could require a recurring transfer setup.

- Referral bonuses (common with TD Bank or Chase) often need you to invite a friend who completes an action, like opening an account.

For cashback rewards, apps like BeFrugal or Freecash might credit you instantly after your first purchase or survey completion.

Want your $20 today? Follow these hacks:

- Use a debit card instead of a bank transfer for faster verification (works with PayPal and Cash App).

- Opt for platforms with no waiting period—Swagbucks often pays via PayPal within 48 hours if you redeem wisely.

- For crypto bonuses, platforms like Binance may require KYC (identity verification), so have your ID ready to skip delays.

- Stock investing apps like SoFi Invest sometimes run promotions where the bonus lands in your account the same day you fund it.

- Student loan refinancing through SoFi could net you a $20 bonus just for checking your rate—no obligation.

- Side hustles like Branded Surveys pay instantly to PayPal once you hit the $5 threshold.

Warning: Avoid platforms with vague terms. If a free money app promises a $20 bonus but hides requirements in fine print (e.g., “earn 10,000 points first”), it’s not truly instant. Stick to reputable names like Coinbase (for crypto) or Ibotta (for shopping cashback) for transparent deals.

If your bonus doesn’t appear:

- Check spam folders for confirmation emails (common with InboxDollars).

- Verify all steps were completed (e.g., Chime requires a $200 direct deposit).

- Contact support—some reward apps like Freecash resolve issues within hours.

Bottom line: Instant $20 bonuses are real, but how you claim them matters. Prioritize platforms with clear timelines, low barriers, and a history of paying out (like PayPal or Swagbucks). Whether you’re into quick cash from surveys or stock investing perks, the key is acting fast and reading the fine print.

Exclusive 2025 Deals

Here’s a detailed paragraph for "Exclusive 2025 Deals" in Markdown format, focusing on sign-up bonuses and financial incentives:

Looking for instant $20 sign-up bonuses in 2025? The landscape of quick-cash opportunities has evolved, with fintech platforms and traditional banks rolling out competitive offers to attract users. PayPal and Cash App remain go-tos for fast transfers, but newer players like Current and Chime are upping the ante with no-fee banking and referral bonuses. For crypto enthusiasts, Binance and Coinbase still dominate with limited-time deposit matches, while Crypto.com offers tiered rewards for staking. If you’re into micro-investing, Acorns and SoFi provide free stock or ETF shares for new accounts, and MooMoo (backed by TD Bank) has surged in popularity with its commission-free trading perks.

Survey apps like Swagbucks and Branded Surveys are low-effort side hustles, but the real gems are cashback platforms. Ibotta and BeFrugal now feature boosted payouts for grocery receipts, while InboxDollars has streamlined its reward system for 2025. For passive income, Albert’s AI-driven savings tools and Chase’s refreshed checking account bonuses (up to $300) are worth exploring. Pro tip: Stack these deals—many platforms allow dual rewards (e.g., signing up for Freecash via a SoFi referral nets bonuses from both). Always read fine print: Some require minimum deposits (like E*TRADE’s $1,000 threshold) or activity tiers (e.g., InboxDollars’ 5-task minimum).

Timing matters too. Q1 2025 sees aggressive promotions as companies chase fiscal targets, so prioritize platforms with expiring limited-time offers. For crypto deals, watch for Coinbase’s seasonal “Learn & Earn” campaigns, which often include free crypto for completing tutorials. Meanwhile, student loan refinancing bonuses (common with SoFi) are peaking ahead of federal repayment resumptions. Whether you’re after stock investing perks or cashback rewards, diversify your sign-ups to maximize returns without overcommitting. Remember: These deals are designed to hook you—set reminders to cancel unused subscriptions before fees kick in.

This paragraph integrates the requested entities and LSI keywords naturally while providing actionable insights for 2025-specific opportunities. Let me know if you'd like adjustments to tone or depth!

Mobile-Friendly Offers

Mobile-Friendly Offers: The Best Apps to Score a $20 Sign-Up Bonus in 2025

In today’s fast-paced digital world, mobile-friendly platforms are dominating the earn money online space, making it easier than ever to snag a $20 sign-up bonus with just a few taps. Whether you’re into crypto trading, cashback rewards, or side hustles, there’s an app for you. Leading the pack are fintech giants like PayPal, Cash App, and SoFi, which offer seamless mobile experiences alongside instant rewards. For example, Cash App frequently runs promotions for new users who link their debit cards, while SoFi rewards you for setting up direct deposits—perfect for those looking to streamline their personal finance game.

If you’re into investment platforms or stock investing, apps like MooMoo and ETRADE provide referral bonuses just for signing up and funding your account. MooMoo, in particular, stands out with its user-friendly interface and generous sign-up rewards, often including free stocks or cash bonuses. Meanwhile, crypto trading enthusiasts can turn to Binance or Coinbase, which occasionally offer quick cash incentives for new users who complete their first trade. These platforms are designed for on-the-go trading, so you can claim your bonus without being tied to a desktop.

For those who prefer micro investing or student loan refinancing, Acorns and SoFi are top contenders. Acorns rounds up your everyday purchases to invest the spare change, and they often waive their monthly fee for new users—effectively putting money back in your pocket. On the other hand, SoFi isn’t just about banking; their mobile app also simplifies loan refinancing, sometimes pairing it with a sign-up bonus to sweeten the deal.

Survey and reward apps like Swagbucks, InboxDollars, and Branded Surveys are also optimized for mobile, letting you earn online income while waiting in line or during your commute. Swagbucks, for instance, rewards you for completing surveys, watching videos, or even shopping through their app—all activities that can be done from your smartphone. Similarly, Freecash gamifies the process with instant payouts to PayPal or Crypto.com, making it a favorite for quick cash seekers.

Don’t overlook cashback apps like Ibotta and BeFrugal, which turn everyday shopping into earning opportunities. Ibotta’s mobile app is a powerhouse for grocery savings, offering cashback rewards on items you already buy, plus bonuses for redeeming your first offer. BeFrugal takes it a step further by aggregating deals from thousands of retailers, all accessible from your phone.

Banking apps haven’t been left behind either. Chime, Current, and TD Bank frequently roll out mobile-exclusive promotions, such as $20 sign-up bonuses for opening a new account or setting up direct deposits. Chase also jumps in with limited-time offers, especially for students or young professionals looking to boost their personal finance strategy.

The key to maximizing these mobile-friendly offers is to stay updated on the latest promotions—many apps rotate their bonuses quarterly or during holidays. Always read the fine print to ensure you qualify (e.g., minimum deposits or activity requirements), and don’t hesitate to stack bonuses by referring friends. With so many fintech platforms competing for your attention in 2025, your smartphone could be your newest money-making tool.

No-Surprise Terms

When it comes to no-surprise terms for instant $20 sign-up bonuses, transparency is everything. Many platforms—like PayPal, Cash App, or Chime—offer quick cash rewards, but the fine print can make or break the deal. For example, SoFi might require a minimum deposit to unlock their bonus, while TD Bank could ask for a direct deposit setup. Always check if the bonus is tied to specific actions, like completing a certain number of transactions or maintaining a balance for a set period. Crypto.com and Binance often have referral bonuses with clear terms, but crypto trading platforms may require KYC verification before you can withdraw your reward.

Survey platforms like Swagbucks, Branded Surveys, or InboxDollars usually outline their sign-up rewards upfront, but some may require you to earn a threshold (e.g., $10) before cashing out. Similarly, cashback apps like Ibotta or BeFrugal might credit your account instantly, but withdrawals could take days or require a linked PayPal or bank account. If you’re exploring investment platforms like MooMoo or Acorns, their micro-investing bonuses often come with trade requirements—so read the terms to avoid surprises.

Here’s a pro tip: Financial services like Chase or ETRADE sometimes offer student loan refinancing or stock investing perks alongside sign-up bonuses, but these may have longer holding periods. For fintech platforms like Current or Albert**, the bonus might be tied to direct deposit activation. Always ask: Is there a time limit? Are there hidden fees? For instance, Freecash pays out quickly, but some reward apps delay payouts if you don’t meet activity quotas.

Bottom line: Whether you’re using side hustles for online income or leveraging cashback rewards, understanding the terms ensures you actually get that quick cash. Platforms like Coinbase or Crypto.com are great for crypto trading bonuses, but their requirements (like trading volume) can be strict. Meanwhile, personal finance apps like SoFi or Albert often bundle bonuses with other services—just make sure you’re not signing up for something you won’t use. Always double-check the details to keep your earn money online journey frustration-free.

Bonus Comparison Guide

When it comes to sign-up bonuses, not all offers are created equal. Whether you're looking for quick cash, crypto trading perks, or cashback rewards, understanding the fine print is key. Let’s break down some of the top platforms and what they bring to the table:

- Binance vs. Coinbase: If you're diving into crypto trading, Binance often offers higher referral bonuses for new users, while Coinbase provides a simpler onboarding process with free money for learning about crypto. Both platforms frequently update their promotions, so check their latest offers before signing up.

- Cash App vs. PayPal: Cash App’s $20 sign-up bonus (often tied to a minimum deposit) is a solid deal, but PayPal’s broader merchant acceptance makes it better for cashback apps and online shopping. If you're splitting bills or sending money, Cash App’s instant transfers might edge out PayPal’s slower processing times.

- Swagbucks vs. Branded Surveys: For earn money online enthusiasts, Swagbucks offers a mix of surveys, shopping rewards, and even a $10 bonus for joining. Branded Surveys, meanwhile, focuses purely on paid surveys but tends to have higher payouts per completed task. If you prefer variety, go with Swagbucks; if you’re laser-focused on surveys, Branded Surveys could net you more side hustles income.

- Investment Platforms (Acorns vs. MooMoo vs. ETRADE): Micro-investing apps like Acorns shine with their round-up investing feature and occasional $5–$10 bonuses, while MooMoo and ETRADE cater to active traders with free stocks for signing up. MooMoo’s referral bonuses are particularly competitive, often including fractional shares of high-value stocks.

- Banking Bonuses (Chase vs. TD Bank vs. Chime): Traditional banks like Chase and TD Bank frequently run $200–$300 sign-up rewards for opening checking accounts, but they usually require direct deposits or minimum balances. Chime, a fintech platform, skips the fees and sometimes offers early paycheck access as part of its perks—though its cash bonuses are rarer.

For financial services that blend convenience with rewards, SoFi and Current stand out. SoFi’s $25–$500 bonuses (depending on the product) are great for student loan refinancing or investing, while Current’s cashback debit card is ideal for personal finance newbies. And don’t overlook Crypto.com—its card tiers offer cashback rewards in crypto, though the staking requirements can be steep.

Pro Tip: Always read the terms. A $20 bonus might require a $100 deposit, or a stock investing offer could lock you into a minimum holding period. Prioritize platforms aligned with your habits—whether that’s survey platforms, stock trading, or cashback apps—to maximize value without jumping through unnecessary hoops.

Secure Sign-Up Tips

Secure Sign-Up Tips for Instant $20 Bonuses in 2025

When claiming instant $20 sign-up bonuses from platforms like Coinbase, PayPal, or Swagbucks, security should always come first. With the rise of fintech platforms and cashback apps, scammers have also gotten smarter—so protecting your personal and financial data is non-negotiable. Here’s how to safely unlock sign-up rewards without compromising your security:

- Use Strong, Unique Passwords: Whether you’re signing up for Crypto.com for crypto trading or Branded Surveys for online income, avoid reusing passwords. A password manager can help generate and store complex credentials.

- Enable Two-Factor Authentication (2FA): Most financial services like SoFi, Chase, and TD Bank offer 2FA. This adds an extra layer of security, especially if you’re accessing investment platforms or micro-investing apps like Acorns.

- Verify the Platform’s Legitimacy: Before entering your info, check reviews and official websites. For example, Freecash and InboxDollars are legit survey platforms, but fake clones exist. Look for SSL encryption (the padlock icon in your browser’s address bar).

- Avoid Sharing Sensitive Data Unnecessarily: Apps like Cash App or Chime only need basic details for quick cash bonuses. If a site asks for excessive info (e.g., Social Security numbers for a referral bonus), it’s a red flag.

- Monitor Your Accounts: After signing up for stock investing apps like MooMoo or **ETRADE, regularly check your linked bank or email for unauthorized activity. Some reward apps also send alerts for suspicious logins.

Pro Tip for Referral Bonuses: If you’re inviting friends to apps like Albert or BeFrugal, share your referral link directly—not through third-party sites. Scammers often fake referral programs to steal data.

Lastly, be cautious with student loan refinancing or personal finance offers. Legit platforms like SoFi won’t ask for upfront fees to claim a sign-up bonus. Stick to trusted names, and you’ll earn that free money safely.

Avoiding Scam Offers

Avoiding Scam Offers

With the rise of fintech platforms and cashback apps offering instant $20 sign up bonuses, it’s easier than ever to earn quick cash—but it’s also easier to fall for scams. The key to avoiding fraudulent offers is knowing how to spot red flags. For example, legitimate platforms like Binance, Coinbase, or PayPal will never ask for sensitive information like your Social Security number upfront just to claim a sign-up bonus. If an offer seems too good to be true (like a $100 bonus for simply signing up with no requirements), it probably is.

One common scam tactic is fake referral bonuses. Platforms like Swagbucks, InboxDollars, and Branded Surveys have transparent referral programs, but scammers often impersonate them with phishing emails or fake websites. Always verify the official domain (e.g., SoFi’s real website is sofi.com, not sofi-rewards.net). Similarly, investment platforms like MooMoo or ETRADE won’t promise guaranteed returns—another major red flag.

Here’s how to protect yourself:

- Check reviews and legitimacy: Before signing up for a free money app like Albert or Current, search for user reviews on Trustpilot or Reddit. Scams often have complaints about withheld payouts.

- Avoid upfront payments: Legit cashback rewards programs (e.g., Ibotta, BeFrugal) don’t require you to pay to join. If an app asks for a "processing fee" to unlock your bonus, walk away.

- Stick to trusted names: Financial services like Chase, TD Bank, or Chime have well-established reputations. Lesser-known apps promising quick cash might be Ponzi schemes.

- Verify crypto offers: Crypto trading platforms like Crypto.com or Cash App are frequently mimicked by scammers. Double-check URLs and official social media accounts.

Another sneaky tactic is fake survey platforms that harvest data instead of paying out. Freecash and Branded Surveys, for instance, are legitimate, but clones might ask for excessive personal details. Always read the fine print—real online income opportunities disclose terms clearly.

For micro investing apps like Acorns, scams often involve fake "bonus deposits" or phishing links. A real stock investing platform will never ask for your login credentials via email. Similarly, student loan refinancing scams target borrowers with fake SoFi or Laurel Road offers—always log in directly through the official app.

Bottom line: Research, skepticism, and sticking to reputable fintech platforms are your best defenses. Whether you’re chasing side hustles or referral bonuses, a few minutes of verification can save you from losing money—or worse, your identity.

Maximizing Free Cash

Maximizing Free Cash

In 2025, earning extra money online is easier than ever, thanks to platforms offering instant $20 sign up bonuses and other perks. Whether you're into crypto trading, cashback rewards, or side hustles, there are countless ways to pad your wallet with minimal effort. For example, Binance and Coinbase frequently roll out referral bonuses for new users who trade cryptocurrencies, while apps like Cash App and PayPal occasionally offer sign up rewards just for linking your bank account. Even if you're not a crypto enthusiast, survey platforms like Branded Surveys and Swagbucks pay you for sharing opinions or completing simple tasks.

For those focused on personal finance, combining multiple fintech platforms can amplify your earnings. Micro investing apps like Acorns and SoFi often match your initial deposits or waive fees for new users, while stock investing platforms such as MooMoo and ETRADE provide free money apps incentives like free stocks. If you prefer cashback apps, Ibotta and BeFrugal reward you for shopping through their portals—stack these with credit card rewards for even bigger savings. Meanwhile, student loan refinancing through SoFi or Chase could unlock lower interest rates, freeing up cash flow.

Here’s how to strategize:

- Layer bonuses: Sign up for Chime or Current to snag their sign-up bonus, then use those funds to meet deposit requirements on investment platforms like TD Bank or Crypto.com.

- Optimize referrals: Many apps, including Albert and InboxDollars, offer extra cash when you refer friends. Share your link on social media or forums to maximize payouts.

- Rotate promotions: Platforms like Freecash and Swagbucks frequently update their quick cash offers. Check back weekly to capitalize on limited-time deals.

The key is consistency—dedicate just 10-15 minutes daily to earn money online through these methods, and those small bonuses will add up fast. Whether you're saving for a vacation or building an emergency fund, leveraging financial services strategically ensures you’re always maximizing free cash.

Tax Implications Explained

Tax Implications Explained

When you score a $20 sign-up bonus from platforms like PayPal, SoFi, Chase, or Cash App, it might feel like free money—but Uncle Sam likely sees it differently. Here’s the deal: The IRS treats most sign-up rewards, referral bonuses, and even cashback rewards as taxable income. Whether you’re earning through survey platforms (Branded Surveys, Swagbucks), investment apps (Acorns, MooMoo), or fintech platforms (Chime, Current), that extra cash could bump up your tax bill.

For example, crypto trading apps like Binance and Coinbase typically issue a 1099-MISC or 1099-K if your rewards exceed $600 in a year. Even smaller bonuses from Cash App or Crypto.com may require self-reporting if they’re tied to referrals or promotions. The same goes for micro-investing apps (Acorns, ETRADE)—dividends and bonuses count as income.

Pro tip: Keep records of every instant $20 sign-up bonus, especially from side hustles like Freecash or InboxDollars. Apps like Ibotta or BeFrugal might not send tax forms for small amounts, but you’re technically still obligated to report earnings.

Here’s where it gets tricky: Stock investing platforms (TD Bank, SoFi) often classify bonuses as "rebates," which might be tax-free—but consult a pro to be sure. Meanwhile, student loan refinancing bonuses (SoFi, Albert) are usually treated as taxable income unless applied directly to your loan.

Quick checklist for tax season:

- Track bonuses from financial services apps (Chase, PayPal) in a spreadsheet.

- Save any tax forms from reward apps (Swagbucks, Branded Surveys).

- Separate referral bonuses (Cash App, Crypto.com) from nontaxable cashback.

- When in doubt, assume it’s taxable—especially with crypto trading or fintech platforms.

Bottom line: That $20 quick cash could cost you at tax time. Plan ahead, and consider setting aside 20-30% for potential taxes if you’re stacking online income from multiple apps.

Referral Bonus Hacks

Referral Bonus Hacks to Maximize Your Earnings in 2025

Want to turbocharge your online income through referral bonuses? Whether you're into crypto trading, cashback rewards, or survey platforms, there are clever ways to stack up sign-up bonuses without spending a dime. Here’s how to make the most of these opportunities—because who doesn’t love free money apps?

Many fintech platforms and investment platforms offer referral programs, but not everyone realizes you can double-dip. For example:

- Crypto Exchanges: Invite friends to Binance or Coinbase, and both of you could earn bonuses in crypto or cash. Some platforms even offer tiered rewards—the more people you refer, the higher the payout.

- Cashback Apps: Apps like Ibotta and Swagbucks often boost referral bonuses during holidays or special promotions. Keep an eye out for limited-time offers where referrals could net you an extra $20 or more.

- Survey Sites: Platforms like Branded Surveys and InboxDollars reward you for bringing in new users. Pro tip: Share your referral link in online communities (where allowed) to reach a wider audience.

Some apps and banks offer seasonal boosts. For instance:

- PayPal occasionally runs referral campaigns where you and your friend each get $10-$20 for signing up and completing a small transaction.

- Chime and Current frequently update their referral programs, sometimes offering $50 or more per successful sign-up.

- Investment apps like MooMoo or Acorns may provide free stocks or cash bonuses for referrals who fund their accounts.

Why stop at just a referral bonus? Many platforms let you stack rewards:

1. Cash App: Refer a friend, and you might both earn $5-$15, but also take advantage of their Boosts program for extra cashback at retailers.

2. SoFi: Their referral program often includes student loan refinancing perks or stock investing bonuses alongside cash rewards.

3. *ETRADE and TD Bank: These financial services giants sometimes bundle referral bonuses with waived fees or free trades.

If you’re serious about side hustles, turn referrals into a semi-passive stream:

- Create Content: Share your referral links in blog posts, YouTube videos, or social media (without being spammy). For example, a tutorial on how to earn money online with Freecash could include your link.

- Join Referral Groups: Some Reddit and Facebook groups allow users to exchange referrals (e.g., you sign up for my Crypto.com account, I’ll sign up for your Albert). Just follow group rules to avoid bans.

- Maximize Family/Friends: Politely ask close contacts if they’d use a service like Chase or BeFrugal. They get a bonus, you get a bonus—everyone wins.

While referral programs are great for quick cash, watch out for:

- Expiration Dates: Some bonuses (like those from Swagbucks) require your referral to complete actions within a set time.

- Minimum Deposits: Apps like MooMoo or SoFi may require your friend to fund their account to trigger your bonus.

- Fraud Prevention: Don’t misuse referral systems (e.g., fake accounts). Platforms like PayPal and Coinbase can freeze rewards if they detect abuse.

By strategically leveraging these referral bonus hacks, you can turn small actions into significant online income. Whether you’re into micro investing, stock investing, or just love cashback apps**, there’s always a way to earn more. Keep experimenting and tracking which platforms offer the best ROI in 2025!