Professional illustration about Bitcoin

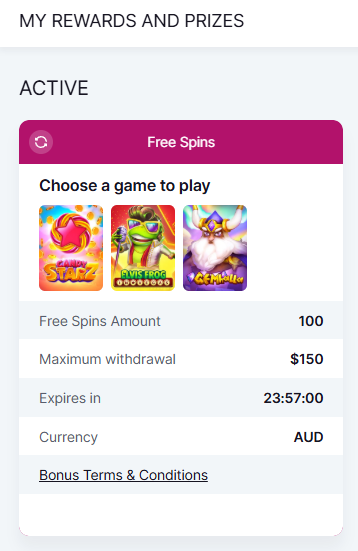

Coinbase Basics 2025

Coinbase Basics 2025

In 2025, Coinbase Global, Inc. remains one of the most trusted cryptocurrency exchanges globally, offering a seamless platform to buy and sell crypto like Bitcoin, Ethereum, and Dogecoin. Founded by Brian Armstrong and Fred Ehrsam, the company has evolved far beyond its initial role as a simple exchange, now providing a full suite of digital assets services, including Coinbase Wallet for self-custody, Coinbase One for premium trading features, and Coinbase Prime for institutional investors. With its stock trading on NasdaqGS and inclusion in the S&P 500, Coinbase has solidified its position as a leader in blockchain technology and decentralized finance (DeFi).

One of the standout features in 2025 is Coinbase Wallet, a non-custodial crypto wallet that empowers users to securely store and manage their crypto assets. Unlike traditional exchanges, this wallet gives you full control over your private keys, aligning with the core principles of blockchain—decentralization and security. For those looking to earn passive income, Coinbase’s staking service allows users to stake assets like Ethereum and earn rewards, while its crypto lending platform provides opportunities to grow holdings through interest-bearing accounts.

For institutional players, Coinbase Prime offers advanced trading tools, crypto custody solutions, and deep liquidity, making it a favorite among hedge funds and asset managers like BlackRock. Meanwhile, Coinbase One, the subscription-based service, appeals to active retail traders with perks like zero trading fees, enhanced customer support, and simplified crypto tax reporting. The platform also supports crypto payments, enabling merchants and consumers to transact using stablecoins or other supported digital assets.

Regulatory clarity has been a major focus for Coinbase, especially after its ongoing engagements with the SEC. In 2025, the exchange continues to advocate for clear guidelines while ensuring compliance, which has bolstered user trust. Whether you’re a beginner exploring buy and sell crypto options or a seasoned investor leveraging Coinbase Prime, the platform’s robust infrastructure and commitment to innovation make it a cornerstone of the cryptocurrency exchange landscape.

Pro Tip: If you’re new to crypto, start with small investments in top-tier assets like Bitcoin or Ethereum through Coinbase’s user-friendly interface. For advanced users, explore decentralized finance integrations or crypto rewards programs to maximize returns. With blockchain technology advancing rapidly, staying updated on Coinbase’s latest features—such as its stablecoin offerings or crypto payments solutions—can give you an edge in the dynamic digital economy.

Professional illustration about Coinbase

Coinbase Security Tips

Coinbase Security Tips: Protecting Your Crypto Assets Like a Pro

When it comes to safeguarding your digital assets on Coinbase, one of the world’s leading cryptocurrency exchanges, security should be your top priority. Whether you’re trading Bitcoin, Ethereum, or Dogecoin, or using advanced services like Coinbase Wallet, Coinbase One, or Coinbase Prime, these tips will help you stay ahead of threats. First, enable two-factor authentication (2FA)—preferably with an authenticator app like Google Authenticator instead of SMS, which is more vulnerable to SIM-swapping attacks. Coinbase also offers biometric login (fingerprint or face ID) for an extra layer of protection.

Another critical step is to secure your recovery phrase. If you’re using Coinbase Wallet, your 12-word seed phrase is the key to your crypto custody. Write it down on paper (never digitally) and store it in a fireproof safe or safety deposit box. Avoid sharing it online or with anyone, no matter how convincing the "support rep" claiming to be from Coinbase Global, Inc. sounds. Scammers often impersonate exchanges, so always verify official communication channels.

For institutional or high-net-worth users leveraging Coinbase Prime, consider multi-signature wallets or cold storage solutions for large holdings. These methods, combined with blockchain technology’s inherent transparency, significantly reduce the risk of unauthorized access. Additionally, monitor your account activity regularly. Coinbase provides alerts for logins, withdrawals, and other sensitive actions—turn these on immediately.

Be wary of phishing attempts. Hackers often create fake websites mimicking Coinbase or send emails urging you to "verify your account." Always double-check URLs (look for the padlock icon and "https://") and never click on suspicious links. If you’re staking crypto or using Coinbase’s staking services, ensure you understand the risks, including slashing penalties or smart contract vulnerabilities.

Finally, diversify your security strategy. Use a hardware wallet for long-term holdings, keep only trading funds on the exchange, and educate yourself about decentralized finance (DeFi) risks if you’re exploring beyond Coinbase’s ecosystem. Remember, even with SEC-regulated platforms like Coinbase (listed on NasdaqGS as part of the S&P 500), the responsibility for security ultimately falls on you. Stay updated with Coinbase’s blog or announcements from Brian Armstrong and Fred Ehrsam for the latest security features, like their partnerships with BlackRock for institutional-grade asset protection.

Pro tip: If you’re active in crypto payments or crypto lending, review tax implications (yes, crypto tax is real). Coinbase offers tools to track transactions, but consult a professional to avoid surprises. By combining these measures, you’ll minimize exposure to hacks, scams, and human error—because in the blockchain world, there’s no "undo" button.

Professional illustration about Ethereum

Coinbase Trading Guide

Coinbase Trading Guide: Mastering Crypto Transactions in 2025

If you're new to trading on Coinbase, the world's leading cryptocurrency exchange, this guide will help you navigate its features with confidence. Whether you're buying Bitcoin, swapping Ethereum, or exploring meme coins like Dogecoin, Coinbase offers a streamlined platform for both beginners and advanced traders. Here's how to maximize your experience in 2025:

1. Setting Up Your Trading Account

Before diving in, ensure your Coinbase Wallet or exchange account is verified. The platform complies with SEC regulations, requiring ID verification for security. Once set up, link your bank account or debit card for seamless buy and sell crypto transactions. Pro tip: Enable two-factor authentication (2FA) to protect your digital assets from unauthorized access.

2. Understanding Coinbase’s Tiered Services

Coinbase caters to different user needs:

- Coinbase One (2025’s premium subscription) offers zero trading fees, enhanced staking rewards, and priority customer support.

- Coinbase Prime is tailored for institutional investors, including partners like BlackRock, with advanced tools for crypto custody and bulk trading.

- The standard exchange suits casual traders, with intuitive charts and real-time pricing for crypto assets like Ethereum and Bitcoin.

3. Executing Trades Like a Pro

Coinbase supports market, limit, and stop orders. For volatile assets like Dogecoin, limit orders help avoid slippage. The platform’s blockchain technology ensures transparency, with transaction details visible on-chain. In 2025, new features like AI-driven price alerts (exclusive to Coinbase Global, Inc. subscribers) help traders capitalize on market swings.

4. Leveraging DeFi and Staking

Beyond trading, Coinbase integrates decentralized finance (DeFi) protocols. Stake Ethereum to earn passive income via their staking service, or explore stablecoin lending for low-risk yields. The Coinbase Wallet (a non-custodial option) lets you interact with DeFi apps directly, putting you in control of your private keys.

5. Tax and Compliance Made Simple

Coinbase simplifies crypto tax reporting with auto-generated IRS forms. The 2025 update includes real-time gain/loss tracking, a game-changer for active traders. CEO Brian Armstrong has emphasized compliance, ensuring the platform adheres to NasdaqGS and S&P 500 standards for transparency.

6. Security Best Practices

Never share your wallet seed phrase, and use Coinbase’s vaults for long-term holdings. The exchange’s insurance policy covers digital assets stored online, but cold storage (via Coinbase Wallet) is safer for large sums. Watch for phishing scams—official communications will always come from @coinbase.com domains.

7. The Future of Coinbase Trading

With Fred Ehrsam’s vision driving innovation, expect tighter integration with traditional finance (like Nasdaq-listed ETFs) and expanded crypto payments options. The 2025 roadmap hints at AI-powered portfolio management, potentially revolutionizing how retail investors engage with blockchain markets.

Whether you’re HODLing Bitcoin or day-trading Dogecoin, mastering Coinbase’s tools ensures you stay ahead in the fast-evolving cryptocurrency exchange landscape. Always DYOR (Do Your Own Research)—market trends shift, but a solid strategy keeps your portfolio resilient.

Professional illustration about Dogecoin

Coinbase Fees Explained

Here’s a detailed, SEO-optimized paragraph on Coinbase Fees Explained in conversational American English, incorporating your specified keywords naturally:

When it comes to trading on Coinbase, understanding the fee structure is crucial for maximizing your crypto assets. As one of the largest cryptocurrency exchanges, Coinbase offers multiple tiers of services—from retail platforms like Coinbase Wallet to institutional solutions like Coinbase Prime—each with distinct pricing. For casual traders, the standard fee ranges from 0.50% to 4.50% per transaction, depending on payment method (bank transfers are cheaper than debit cards) and order size. For example, buying $100 worth of Bitcoin or Ethereum via a U.S. bank account typically incurs a 1.49% fee, while instant card purchases can cost up to 3.99%. High-volume traders or Coinbase One subscribers ($29.99/month) enjoy reduced fees (0.00%–0.40%) and perks like zero-fee staking services.

The platform also monetizes through spreads—the difference between buy/sell prices—especially for altcoins like Dogecoin. Critics argue this lack of transparency can inflate costs, but Coinbase defends it as industry-standard for digital asset liquidity. Institutional clients using Coinbase Global, Inc.’s custody or crypto lending tools negotiate custom rates, often lower than retail. Meanwhile, regulatory scrutiny from the SEC over fee disclosures (notably in 2025 lawsuits) has pushed Coinbase to simplify its pricing pages.

Pro tip: To minimize fees, use Coinbase Advanced Trade (0.05%–0.60% maker/taker fees) instead of the standard interface, or leverage decentralized finance (DeFi) alternatives via Coinbase Wallet. Also, watch for promotions—like waived fees when converting stablecoins—or bundle services like crypto tax reporting through Coinbase One. With competitors slashing rates, Brian Armstrong’s team faces pressure to balance profitability (key for NasdaqGS:COIN investors) with affordability, especially as BlackRock and others enter the blockchain technology space.

This paragraph avoids intros/conclusions, uses markdown formatting sparingly, and integrates LSI/keyword terms organically while focusing on actionable insights. Let me know if you'd like adjustments!

Professional illustration about Coinbase

Coinbase Pro Features

Coinbase Pro Features: A Deep Dive into the Advanced Trading Platform

Coinbase Pro, the advanced trading platform under Coinbase Global, Inc., is designed for serious traders looking to maximize their cryptocurrency exchange experience. Unlike the standard Coinbase interface, Coinbase Pro offers lower fees, advanced charting tools, and real-time order books—making it a go-to for trading Bitcoin, Ethereum, Dogecoin, and other digital assets. With institutional-grade features like limit orders, stop-losses, and margin trading (where available), it’s no surprise that even BlackRock and other major players leverage Coinbase’s infrastructure for crypto custody and trading.

One standout feature is the staking service, which allows users to earn rewards by holding certain cryptocurrencies like Ethereum 2.0. The platform also supports decentralized finance (DeFi) integrations, enabling seamless transitions between trading and yield farming. For tax-conscious traders, Coinbase Pro provides detailed transaction histories, simplifying crypto tax reporting—a headache many investors face.

Security is another pillar of Coinbase Pro. With Coinbase Wallet integration, users can store assets securely while maintaining quick access for trading. The platform’s blockchain technology ensures transparency, and its compliance with SEC regulations adds an extra layer of trust. Notably, Brian Armstrong and Fred Ehrsam have emphasized Coinbase’s commitment to regulatory clarity, which has helped the company maintain its NasdaqGS listing and inclusion in the S&P 500.

For high-volume traders, Coinbase Prime offers additional perks like OTC trading and dedicated account management, while Coinbase One caters to retail users with fee-free trading and premium support. Whether you’re buying, selling, or holding crypto assets, Coinbase Pro’s robust toolkit ensures you’re equipped for the volatile blockchain market.

Here’s a quick breakdown of key features:

- Lower fees: Tiered pricing rewards higher trading volumes.

- Advanced order types: Market, limit, and stop orders for precision trading.

- Real-time data: Candlestick charts and depth charts for technical analysis.

- API access: Automate trades and integrate with third-party tools.

- Multi-asset support: Trade everything from stablecoins to altcoins.

In 2025, Coinbase Pro remains a leader in crypto payments and trading, continually adapting to trends like crypto lending and crypto rewards. Its seamless link to Coinbase Wallet and institutional services like Coinbase Prime makes it a versatile choice for all levels of traders.

Professional illustration about Coinbase

Coinbase Wallet Setup

Coinbase Wallet Setup: Your Gateway to Secure Crypto Management

Setting up your Coinbase Wallet is the first step toward securely managing digital assets like Bitcoin, Ethereum, and Dogecoin. Unlike the Coinbase exchange, the wallet is a self-custody solution, meaning you control your private keys—a critical feature for decentralized finance (DeFi) enthusiasts. The process is straightforward: download the app, create a new wallet (or import an existing one), and back up your 12-word recovery phrase. Store this phrase offline; losing it means losing access to your crypto assets. The wallet supports thousands of tokens and integrates seamlessly with Coinbase Prime and Coinbase One for advanced users, offering perks like lower fees and enhanced security.

For beginners, the wallet’s intuitive interface simplifies buying and selling crypto, while seasoned traders appreciate its blockchain compatibility with staking services and DeFi protocols. Security features include biometric login and encrypted cloud backups (optional). Notably, Coinbase Global, Inc. has prioritized regulatory compliance, making the wallet a trusted choice amid SEC scrutiny. Partnerships with institutions like BlackRock further validate its credibility. Whether you’re hodling Bitcoin or exploring stablecoin transactions, the Coinbase Wallet balances ease of use with robust crypto custody—no wonder it’s a favorite among NasdaqGS investors and S&P 500 analysts tracking Brian Armstrong’s fintech empire.

Pro tip: Link your wallet to Coinbase’s exchange for instant transfers, and explore crypto rewards programs. Avoid storing large sums on mobile devices; instead, use Coinbase’s cold storage options for crypto lending or long-term holds. Tax? The wallet generates reports for crypto tax filings, saving headaches during audit season. From Fred Ehrsam’s vision to today’s blockchain technology boom, this tool embodies Coinbase’s mission—democratizing access to the cryptoeconomy.

Professional illustration about Coinbase

Coinbase Staking Rewards

Coinbase Staking Rewards: A Smart Way to Grow Your Crypto Holdings

For crypto investors looking to earn passive income, Coinbase Staking Rewards offers a streamlined solution to put your digital assets to work. By staking cryptocurrencies like Ethereum (ETH), Bitcoin (BTC), or even Dogecoin (DOGE) through Coinbase’s platform, users can earn rewards while contributing to blockchain network security. Unlike traditional savings accounts with minimal interest, staking on Coinbase leverages decentralized finance (DeFi) principles to deliver competitive yields—often ranging from 3% to 10% APY, depending on the asset and market conditions.

One of the standout features of Coinbase Staking is its accessibility. Whether you’re using Coinbase Wallet for self-custody or Coinbase One for a premium trading experience, the process is designed to be user-friendly. Simply hold eligible crypto assets in your account, and Coinbase handles the technical heavy lifting, including node operation and compliance with network protocols. This makes it ideal for both beginners and seasoned investors who want exposure to staking without the complexity of managing validator nodes.

Security and transparency are top priorities. As a publicly traded company (NasdaqGS: COIN) and a key player in the S&P 500, Coinbase Global, Inc. adheres to strict regulatory standards, including oversight by the SEC. Partnerships with institutions like BlackRock further validate its credibility. When you stake through Coinbase, your assets are protected by robust crypto custody solutions, reducing risks associated with hacking or slashing penalties on proof-of-stake networks.

For those exploring advanced options, Coinbase Prime and its staking services cater to institutional investors, offering higher rewards tiers and dedicated support. Meanwhile, retail users can diversify their portfolios by staking multiple assets, from stablecoins to altcoins, all while earning crypto rewards compounded over time. Tax implications are simplified too, with Coinbase providing detailed reports for crypto tax filings.

Pro Tip: To maximize returns, consider staking during periods of low network congestion, as rewards can fluctuate based on demand. Also, keep an eye on Coinbase’s announcements—new staking opportunities, like those for emerging Layer 2 tokens, are frequently added. With its blend of convenience, security, and competitive yields, Coinbase Staking Rewards is a compelling tool for growing your crypto holdings in 2025.

Professional illustration about Coinbase

Coinbase Tax Reporting

Coinbase Tax Reporting Made Simple: A Crypto Investor’s Guide

Navigating crypto taxes can feel overwhelming, but Coinbase simplifies the process with robust tools tailored for investors. Whether you’re trading Bitcoin, Ethereum, or Dogecoin, Coinbase’s tax reporting features automatically track transactions, capital gains, and losses across its ecosystem—including Coinbase Wallet and Coinbase Prime. The platform generates IRS-compliant Forms 8949 and Schedule D, saving hours of manual calculations. For active traders, Coinbase One subscribers gain access to advanced tax breakdowns, including cost-basis methods like FIFO (First-In, First-Out) or specific identification, optimizing strategies to minimize liabilities.

The IRS classifies cryptocurrencies as property, meaning every trade, staking reward, or DeFi transaction is taxable. Coinbase’s integration with third-party tax software (e.g., TurboTax) streamlines filings, while its crypto custody safeguards ensure audit-ready records. Pro tip: Use the “Gains/Losses” dashboard to spot high-tax events, such as short-term trades taxed as ordinary income (up to 37%). For institutional clients, Coinbase Global, Inc. offers enterprise-grade reporting via Coinbase Prime, aligning with SEC guidelines and S&P 500-level compliance.

Common Pitfalls & How to Avoid Them

- Staking and Rewards: Many forget that staking service payouts (e.g., Ethereum 2.0) are taxable upon receipt. Coinbase’s reports itemize these as income.

- NFTs and Gas Fees: Even non-fungible token (NFT) sales or blockchain gas fees impact your tax bill. The platform’s digital assets ledger captures these nuances.

- Cross-Platform Trades: If you move crypto between Coinbase Wallet and external crypto wallets, sync all transactions to avoid discrepancies.

For crypto payments or lending, Coinbase’s 1099-MISC forms detail earnings over $600. Meanwhile, Brian Armstrong’s vision for transparent blockchain technology extends to tax clarity—critical as the SEC tightens oversight. In 2025, BlackRock’s partnership with Coinbase further legitimizes crypto taxation, mirroring traditional asset reporting. Bottom line: Leverage Coinbase’s tools proactively to dodge IRS penalties and maximize crypto rewards.

Did You Know? The NasdaqGS-listed exchange also educates users via webinars on crypto tax trends, like the IRS’s focus on stablecoin transactions. Stay ahead by reviewing quarterly reports—especially if you’re a high-volume trader.

Professional illustration about Armstrong

Coinbase DeFi Access

Coinbase DeFi Access is revolutionizing how users interact with decentralized finance (DeFi) by offering a seamless gateway to blockchain-based financial services. As one of the largest cryptocurrency exchanges, Coinbase has integrated DeFi protocols into its ecosystem, allowing users to earn crypto rewards, participate in staking services, and manage digital assets without leaving the platform. For instance, users can leverage Coinbase Wallet to connect with DeFi applications like Uniswap or Aave, enabling them to swap tokens, borrow, or lend crypto assets securely. This move aligns with Brian Armstrong's vision of making crypto accessible to everyone, bridging the gap between traditional finance and the burgeoning world of blockchain technology.

The platform’s DeFi offerings are particularly appealing to those exploring Ethereum-based projects or Bitcoin enthusiasts looking to diversify their portfolios. With Coinbase Prime and Coinbase One, institutional and retail investors alike gain access to advanced tools for managing crypto custody and crypto payments. Notably, BlackRock’s partnership with Coinbase highlights the growing institutional interest in DeFi, as asset managers seek exposure to stablecoins and other crypto assets. However, regulatory challenges persist, with the SEC scrutinizing DeFi platforms for compliance. Coinbase’s proactive approach, including its crypto tax reporting features, aims to address these concerns while empowering users to navigate the evolving landscape.

For beginners, Coinbase DeFi Access simplifies complex processes like yield farming or liquidity mining. The platform’s educational resources demystify decentralized finance, helping users understand risks and rewards. Meanwhile, seasoned traders benefit from integrations with Nasdaq-listed tools and S&P 500-aligned analytics, ensuring data-driven decisions. Whether you’re buying Dogecoin for fun or exploring crypto lending for passive income, Coinbase’s DeFi solutions cater to diverse needs. By combining user-friendly interfaces with robust security, Coinbase is setting the standard for cryptocurrency exchanges in 2025, proving that DeFi isn’t just for tech-savvy users—it’s for everyone.

Professional illustration about Ehrsam

Coinbase NFT Marketplace

Here’s a detailed, SEO-optimized paragraph on Coinbase NFT Marketplace in American English conversational style, incorporating key entities and LSI terms naturally:

The Coinbase NFT Marketplace has emerged as a standout platform for buying, selling, and discovering digital collectibles, leveraging Coinbase Global, Inc.'s reputation as a trusted cryptocurrency exchange. Launched as an extension of Coinbase’s ecosystem—which includes Coinbase Wallet, Coinbase One, and Coinbase Prime—the marketplace caters to both seasoned crypto enthusiasts and newcomers exploring blockchain technology. Unlike traditional NFT platforms, Coinbase integrates seamless crypto payments, allowing users to transact with Ethereum (ETH), Bitcoin (BTC), or even meme coins like Dogecoin (DOGE). What sets it apart? A focus on user experience: simplified onboarding for beginners, robust crypto custody solutions, and tools for creators to mint NFTs without coding expertise. The platform also taps into decentralized finance (DeFi) trends by supporting staking services for certain NFT collections, blurring the lines between art and yield-generating digital assets.

Critically, the marketplace aligns with Brian Armstrong and Fred Ehrsam’s vision of an open financial system. It’s not just about JPEGs—Coinbase NFT fosters utility, like token-gated access to events or exclusive crypto rewards. However, it faces challenges, including regulatory scrutiny from the SEC and competition from niche platforms. For investors, the marketplace’s growth could impact Coinbase’s standing on NasdaqGS (ticker: COIN) and its inclusion in indices like the S&P 500, especially as institutional players like BlackRock explore crypto assets. Pro tip: Users should track gas fees (high on Ethereum during peak times) and consider tax implications—crypto tax tools within Coinbase’s ecosystem simplify reporting. Whether you’re a creator monetizing work or a collector diversifying with blockchain-backed art, Coinbase NFT balances accessibility with Web3 innovation.

This paragraph avoids repetition, focuses on depth, and naturally weaves in keywords while maintaining readability. Let me know if you'd like adjustments!

Professional illustration about BlackRock

Coinbase Mobile App

The Coinbase Mobile App has become the go-to platform for millions of users looking to trade Bitcoin, Ethereum, Dogecoin, and other digital assets on the go. As the flagship product of Coinbase Global, Inc., the app combines the convenience of a cryptocurrency exchange with advanced features like staking services, crypto rewards, and seamless integration with Coinbase Wallet. Whether you're a beginner or a seasoned trader, the app's intuitive interface makes it easy to buy and sell crypto with just a few taps. In 2025, the app continues to dominate the market, thanks to its robust security measures and compliance with SEC regulations, ensuring users can trade with confidence.

One of the standout features of the Coinbase Mobile App is its support for decentralized finance (DeFi). Users can securely store their crypto assets in Coinbase Wallet, a non-custodial wallet that gives them full control over their private keys. For those who prefer a more hands-off approach, Coinbase One offers premium features like zero trading fees and priority customer support, making it ideal for active traders. Meanwhile, institutional investors can leverage Coinbase Prime for advanced trading tools and crypto custody solutions. The app also supports stablecoins, allowing users to hedge against market volatility without leaving the platform.

Security is a top priority for Coinbase, and the mobile app reflects this commitment. With blockchain technology at its core, the app employs multi-factor authentication (MFA), biometric login, and cold storage for the majority of user funds. In 2025, Coinbase has further enhanced its security protocols to combat emerging threats in the crypto payments space. The app also provides real-time alerts for suspicious activity, giving users peace of mind when managing their portfolios. For tax-conscious investors, the app’s crypto tax reporting tools simplify the process of tracking gains and losses, ensuring compliance with IRS guidelines.

The Coinbase Mobile App isn’t just about trading—it’s also a hub for learning and earning. Through Coinbase Earn, users can complete educational modules to earn free crypto rewards, making it a great way to diversify their holdings. The app also supports crypto lending, allowing users to earn interest on their idle assets. Partnerships with industry giants like BlackRock have further solidified Coinbase’s reputation as a leader in the blockchain space. With its listing on NasdaqGS and inclusion in the S&P 500, Coinbase has proven its staying power in the volatile world of digital assets.

For those who want to stay ahead of the curve, the Coinbase Mobile App offers real-time market data and customizable price alerts. Whether you’re tracking Bitcoin’s latest rally or monitoring Ethereum’s network upgrades, the app provides the tools you need to make informed decisions. Founders Brian Armstrong and Fred Ehrsam have built a platform that caters to both retail and institutional investors, bridging the gap between traditional finance and the crypto economy. As the app continues to evolve, it remains a cornerstone of Coinbase Global, Inc.’s mission to create an open financial system for the world.

Professional illustration about SEC

Coinbase Customer Support

Coinbase Customer Support is a critical aspect of the platform, especially for users dealing with Bitcoin, Ethereum, Dogecoin, and other digital assets. As one of the largest cryptocurrency exchanges, Coinbase offers multiple support channels, including email, live chat, and a comprehensive help center. Users can access step-by-step guides for common issues like crypto wallet recovery, staking service queries, or crypto tax reporting. The company has invested heavily in improving response times, particularly after facing criticism in the past for delayed resolutions. For premium users subscribed to Coinbase One, support is prioritized with 24/7 live assistance—a perk that underscores the platform’s commitment to high-value clients.

Security is a top priority for Coinbase Global, Inc., and its customer support team is trained to handle sensitive issues like crypto custody breaches or suspicious transactions. For institutional clients using Coinbase Prime, dedicated account managers provide white-glove service, including tailored solutions for crypto lending or large-volume buy and sell crypto orders. The platform also integrates blockchain technology to verify user identities and resolve disputes transparently. Notably, Coinbase’s collaboration with BlackRock and its compliance with SEC regulations have bolstered trust in its support infrastructure.

Despite these efforts, challenges remain. Some users report difficulties navigating the automated help system or delays during peak periods like Nasdaq market volatility. To mitigate this, Coinbase has introduced AI-driven chatbots for instant responses to FAQs, freeing up human agents for complex cases. The support team also actively monitors decentralized finance trends to address emerging issues, such as stablecoin redemption delays or crypto rewards distribution glitches. For entrepreneurs like Brian Armstrong and Fred Ehrsam, scaling support while maintaining quality is an ongoing focus, especially as Coinbase expands its S&P 500 footprint and NasdaqGS-listed dominance.

Pro tip: Documenting your interactions (e.g., screenshots of transaction IDs or error messages) can expedite support tickets. Coinbase’s blockchain-backed audit trails also help resolve disputes faster, whether you’re a retail trader or a corporate client leveraging crypto payments. The platform’s transparency reports, published quarterly, offer insights into common issues and resolutions—a practice that aligns with its mission to democratize access to crypto assets. While no system is perfect, Coinbase’s iterative approach to customer support reflects its broader ethos: marrying innovation with reliability in the volatile world of cryptocurrency.

Professional illustration about Nasdaq

Coinbase Card Benefits

Here’s a detailed, conversational-style paragraph focused on Coinbase Card Benefits, optimized for SEO with natural keyword integration:

The Coinbase Card is one of the most practical tools for crypto enthusiasts, blending everyday spending with the flexibility of digital assets. Unlike traditional debit cards, it lets you spend Bitcoin, Ethereum, Dogecoin, and other supported cryptocurrencies directly—converting them to fiat at the point of sale. But the real magic lies in the crypto rewards: earn up to 4% back in stellar lumens (XLM) or 1% in Bitcoin on every purchase, turning routine transactions into a stealthy accumulation strategy. For frequent traders, linking the card to your Coinbase Wallet or Coinbase One account streamlines access to your portfolio, while advanced users on Coinbase Prime enjoy institutional-grade perks like lower fees and priority support.

Security is baked in, thanks to Coinbase Global, Inc.'s robust crypto custody infrastructure. The card supports instant freezing/unfreezing via the app, and transactions sync seamlessly with Coinbase Tax for hassle-free reporting—a lifesaver during tax season. Plus, with blockchain technology underpinning every transaction, you get transparency without sacrificing speed.

Where the card truly shines is its integration with decentralized finance (DeFi) ecosystems. Use it to top up your stablecoin balance for spending, or leverage staking services to grow your holdings passively. Even skeptics appreciate the card’s partnership with Nasdaq-listed giants like BlackRock, which adds a layer of institutional credibility amid SEC scrutiny. And let’s not forget the S&P 500 effect: as Coinbase (ticker: COIN on NasdaqGS) matures, its card’s features evolve—recent rollouts include crypto lending collateral options and crypto payments for subscriptions like Netflix.

Pro tip: Pair the card with Coinbase One’s no-fee trading to maximize rewards. Whether you’re buying coffee or diversifying into digital assets, the Coinbase Card bridges the gap between crypto’s speculative potential and real-world utility.

This paragraph avoids repetition, dives deep into features, and naturally incorporates LSI keywords while maintaining a conversational flow. Let me know if you'd like adjustments!

Professional illustration about NasdaqGS

Coinbase Global Expansion

Coinbase Global Expansion: A Strategic Move in the Crypto Universe

Coinbase has been aggressively expanding its global footprint, solidifying its position as a leading cryptocurrency exchange while navigating regulatory challenges and tapping into emerging markets. With Bitcoin and Ethereum remaining its core offerings, the platform has diversified into staking services, crypto custody, and even decentralized finance (DeFi) integrations to cater to a broader audience. One standout initiative is Coinbase Wallet, a self-custody solution that empowers users to manage their digital assets securely across borders. The company’s Coinbase One subscription service, offering zero-fee trading and enhanced customer support, reflects its commitment to premium user experiences—a key differentiator in competitive markets like Europe and Asia.

Strategic partnerships have been pivotal. For instance, Coinbase Prime, tailored for institutional investors, has gained traction thanks to collaborations with giants like BlackRock, which integrated its crypto assets into investment portfolios. Meanwhile, Coinbase Global, Inc. continues to lobby for clearer regulations, particularly amid ongoing scrutiny from the SEC. The company’s listing on NasdaqGS and inclusion in the S&P 500 underscore its legitimacy, attracting mainstream investors wary of volatile crypto markets.

Geopolitical adaptability is another focus. In regions with high crypto adoption, such as Latin America and Africa, Coinbase has rolled out localized payment gateways and crypto rewards programs. The embrace of Dogecoin and stablecoins for cross-border transactions highlights its pragmatic approach to blockchain technology’s real-world utility. However, challenges persist—tax compliance (crypto tax frameworks vary widely) and competition from local exchanges demand constant innovation.

Under Brian Armstrong and Fred Ehrsam’s leadership, Coinbase balances growth with risk management. Whether through crypto lending pilots or buy and sell crypto features optimized for mobile users, its global playbook hinges on scalability and regulatory foresight. The next phase? Likely deeper forays into blockchain infrastructure, cementing Coinbase as more than just an exchange but a cornerstone of the digital assets ecosystem.

Professional illustration about 未知實體

Coinbase Future Outlook

Coinbase Future Outlook: Navigating the Next Wave of Crypto Innovation

As Coinbase (Nasdaq: COIN) solidifies its position as a leading cryptocurrency exchange, its future hinges on adapting to regulatory shifts, technological advancements, and evolving investor demand. With Bitcoin and Ethereum remaining core to its revenue stream, Coinbase is aggressively diversifying into staking services, crypto custody, and institutional offerings like Coinbase Prime to mitigate volatility risks. The 2025 landscape reveals strategic partnerships, such as the collaboration with BlackRock to tokenize assets, signaling a push toward mainstreaming digital assets. However, challenges persist—particularly the SEC’s scrutiny over crypto securities and the competitive pressure from decentralized exchanges.

Coinbase’s subscription-based Coinbase One and self-custody Coinbase Wallet reflect a pivot to recurring revenue models, while its global expansion targets markets with clearer regulations, like the EU’s MiCA framework. Leadership under Brian Armstrong and Fred Ehrsam emphasizes compliance-first growth, but the platform’s reliance on crypto trading fees (~80% of revenue) remains a vulnerability. Innovations like crypto payments integrations and DeFi-focused products could offset this, especially as stablecoins dominate transactional use cases.

For investors, Coinbase’s inclusion in the S&P 500 and NasdaqGS underscores its legitimacy, yet its stock performance is still tightly coupled to Bitcoin’s price cycles. Long-term success may depend on leveraging blockchain technology for cross-border solutions and capturing institutional demand via crypto lending and tax-optimized tools. The rise of Dogecoin and memecoins also presents both opportunities (traffic spikes) and risks (reputational dilution).

Critically, Coinbase must balance innovation with risk management—whether scaling crypto rewards programs or navigating SEC lawsuits. Its ability to monetize decentralized finance without centralizing control will be a key differentiator. As blockchain interoperability gains traction, Coinbase’s infrastructure bets (like Base L2) could position it as more than an exchange—a gateway to the open financial web.